E-invoicing is a major reform that came along with India’s Goods and Services Tax (GST) framework. It mandates that businesses generate their invoices through the GST portal or a registered invoice registration portal (IRP), ensuring standardization and seamless integration with the GST system. Despite its benefits, there may be instances where an e-invoice needs to be canceled. This article explores the How to cancel an e-invoice in India, addressing common queries, and providing best practices for compliance.

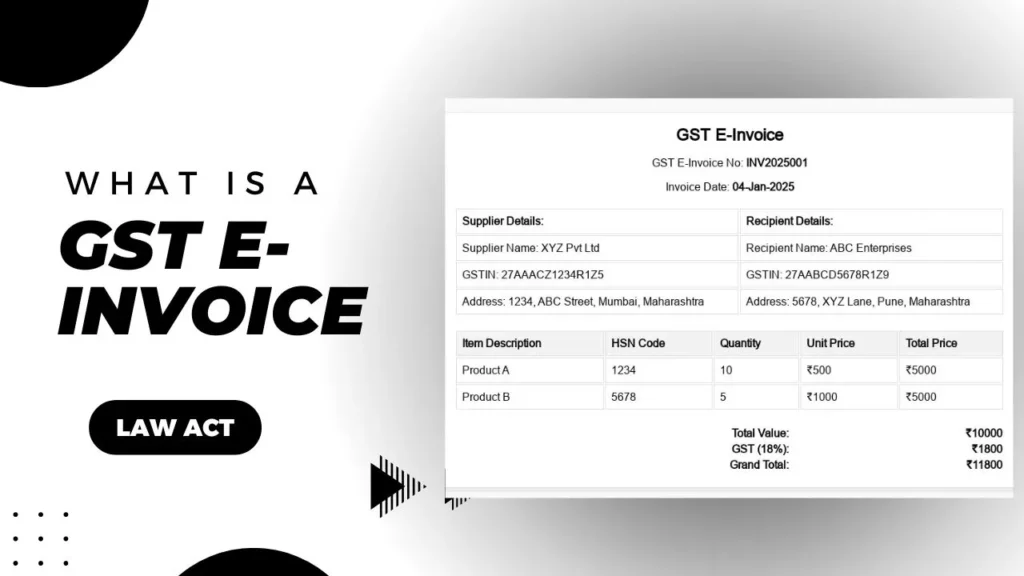

What is e-invoicing?

E-invoicing was introduced to improve tax compliance and curb tax evasion. Under this system, businesses must generate their invoices in a specified format and get them authenticated electronically by the GST Network (GSTN). The authenticated invoice, or e-invoice, includes an Invoice Reference Number (IRN) and a QR code, which are crucial for the invoice’s validity and subsequent GST filings.

What are the reasons for Cancelling an E-Invoice?

You might need to cancel your e-invoice due to several reasons. These reasons may vary anywhere from an error in your invoice

- Errors in Invoice Details: Mistakes such as incorrect customer information, wrong product details, or inaccurate pricing can necessitate a cancellation.

- Duplicate Invoices: If the same invoice is inadvertently generated and sent multiple times, it needs to be canceled.

- Order Cancellations: If a customer cancels an order after the e-invoice has been issued, the invoice needs to be canceled.

- Changes in Order Details: If there are significant changes in the order details after the invoice has been issued, cancellation might be necessary to issue a new invoice with the correct information.

What are the Regulatory Requirements for the cancellation of an E-invoice?

To cancel an e-invoice you need to comply with a few rules and regulations. It’s essential to understand these regulations to ensure compliance. In India, the Goods and Services Tax (GST) regime has specific rules for e-invoice cancellation. According to the GST regulations:

- An e-invoice can be canceled only within 24 hours of its generation.

- Once an e-invoice is canceled, it cannot be edited or reused.

- The cancellation must be reported to the Invoice Registration Portal (IRP) from where the Invoice Reference Number (IRN) was obtained.

Step-by-Step Guide on How to Cancel an E-Invoice.

Access the E-Invoice Portal

- Log in to the e-invoice portal using your credentials.

- Navigate to the ‘e-Invoice’ tab.

Locate the E-Invoice

- Use the search function to locate the e-invoice you intend to cancel. You can search using the IRN, document number, or other relevant criteria.

Initiate Cancellation

- Once you have identified the correct invoice, select it and click on the ‘Cancel’ option.

- The system will prompt you to provide a reason for cancellation. Enter a valid reason, such as ‘Incorrect Details’ or ‘Order Canceled.’

Confirm Cancellation

- After providing the reason, review the information and confirm the cancellation.

- The system will generate a confirmation message with the status of the cancellation.

Verification

- Ensure that the cancellation is reflected in your GST returns. The canceled invoice should not be included in the total invoice count for the period.

How will canceling an E-Invoice impact your business operations?

Impact on Accounting

Canceling an e-invoice can have implications for your accounting records. Ensure that the cancellation is recorded in your accounting software to maintain accurate financial records. This step is crucial for audit purposes and for reconciling your accounts.

Tax Implications

E-invoice cancellations can also affect your tax calculations. For example, in the GST system, the input tax credit (ITC) claimed on a canceled invoice needs to be reversed. Ensure that your tax returns reflect the cancellation to avoid discrepancies.

Customer Relations

Communicate with your customer about the cancellation. Provide them with the reason for the cancellation and issue a corrected invoice if necessary. Transparent communication helps maintain good customer relations and avoids confusion.

Compliance

Adhering to regulatory requirements for e-invoice cancellations is critical to ensure compliance. Failure to follow the prescribed procedures can result in penalties and legal issues. Stay updated with the latest regulations in your jurisdiction to avoid any compliance issues.

To minimize the need for e-invoice cancellations, consider implementing the following best practices:

1. Double-check Invoice Details: Before issuing an e-invoice, verify all details to ensure accuracy.

2. Use Reliable E-Invoicing Software: Invest in robust e-invoicing software that minimizes errors and streamlines the invoicing process.

3. Train Your Staff: Ensure that your team is well-trained in e-invoicing procedures and aware of common errors to avoid.

4. Regular Audits: Conduct regular audits of your invoicing process to identify and rectify any recurring issues.

Conclusion

The e-invoicing system is a significant step towards digitizing and streamlining tax administration in India. However, the need to cancel an e-invoice can arise due to various reasons. Understanding the cancellation process and adhering to the stipulated timeline is crucial for maintaining compliance and ensuring smooth business operations. By following the steps outlined above and adopting best practices, businesses can effectively manage their e-invoices, minimize errors, and enhance overall efficiency.

Also Read:

- What is a GST E-Invoice and How Does It Work?

- Understanding Tax Invoices

- Purchase Orders (PO) and Purchase Invoices (PI)

- What is a Proforma Invoice?

Frequently Asked Questions

What is GST invoice cancellation?

GST invoice cancellation involves canceling a previously issued Goods and Services Tax (GST) invoice, due to errors or changes in the transaction, or to ensure accurate tax records and compliance. The cancellation must be reported in GST returns, usually within a specified time frame, to maintain accurate financial documentation.

When can you cancel a GST invoice?

A GST invoice can be canceled due to errors, transaction changes, duplicates, or compliance needs. This should be done within the same financial period or before filing GST returns for that period to maintain accurate records and compliance with regulations.

How to cancel a GST invoice?

To cancel a GST invoice, issue a credit note referencing the original invoice, detailing the reason for cancellation. Update your accounting records accordingly and include the credit note in your GST returns for the relevant period to ensure accurate financial documentation and compliance.

Can a canceled GST invoice be edited?

No, a canceled GST invoice cannot be edited. Once canceled, the invoice is considered void, and any necessary corrections must be made by issuing a new invoice or a credit note to ensure accurate records and compliance.

What are the steps to cancel a GST invoice online?

To cancel a GST invoice online, log into the GST portal, navigate to the invoice section, select the invoice to cancel, and submit a cancellation request. Record the cancellation with a credit note and update your accounting records to reflect the changes.

Are there penalties for canceling a GST invoice?

No specific penalties exist for canceling a GST invoice if done correctly. However, frequent cancellations without valid reasons may trigger scrutiny from tax authorities, and failing to update records or comply with regulations can result in fines or penalties for inaccurate tax filings.

How does GST invoice cancellation affect returns?

GST invoice cancellation impacts returns by adjusting the taxable sales and corresponding tax liabilities. When a GST invoice is canceled with a credit note, it reduces the reported sales and tax payable in the return period. Properly reflecting cancellations ensures accurate financial reporting and compliance with GST regulations.

What happens if you don’t cancel a GST invoice correctly?

If a GST invoice is not canceled correctly, it can lead to several issues, like Incorrect tax reporting, compliance issues, and audit triggers. It’s crucial to follow proper procedures to cancel GST invoices to avoid these complications and ensure accurate financial and tax reporting.

Can a GST invoice be canceled after filing returns?

Yes, a GST invoice can be canceled after filing returns. If an invoice needs to be canceled after returns are filed, you should issue a credit note for the canceled invoice in the subsequent tax period. This ensures proper documentation and adjustment of tax liabilities in future returns.

How long do you have to cancel a GST invoice?

You can cancel a GST invoice within the same financial year or before filing the GST returns for the month of September following the end of the financial year, whichever is earlier. It’s crucial to adhere to these timelines to maintain accurate tax records and compliance with GST regulations.