A 1099 contractor is a person who works for a business but is not considered an employee. Instead, they are treated as independent workers. The name comes from the IRS Form 1099-NEC, which businesses give to contractors at the end of the year to report how much they were paid.

If you are a 1099 contractor, you are self-employed. You provide services to a company or multiple companies, but you are in charge of your own taxes, benefits, and expenses. You are not on the company’s payroll like a regular employee.

For example, a graphic designer, a plumber, or a freelance writer who gets paid per project rather than a monthly salary could be considered a 1099 contractor.

Why is it Called “1099”?

The name comes directly from the tax paperwork. When a company hires a contractor, it does not give them a W-2 form like it does for employees. Instead, it gives a Form 1099-NEC. This form shows how much the contractor earned during the year.

This difference is important because employees have their income tax, Social Security, and Medicare taxes automatically deducted from their paychecks. Contractors, on the other hand, do not. They must calculate and pay these taxes on their own.

Difference Between 1099 Contractors and W-2 Employees

The most common confusion people face is the difference between being a contractor and being a regular employee. To make it easy, here’s a table:

| Feature | 1099 Contractor | W-2 Employee |

|---|---|---|

| Work Status | Independent worker, self-employed | Official employee of the company |

| Tax Form | Receives Form 1099-NEC | Receives Form W-2 |

| Taxes | Pays own taxes, including self-employment tax | Taxes deducted by employer automatically |

| Benefits | Usually no benefits like health insurance or paid leave | Often receive benefits like insurance, leave, retirement plans |

| Flexibility | Can choose projects, set own hours | Must follow company’s schedule and policies |

| Job Security | Less secure, project-based | More stable with long-term employment |

This comparison shows that contractors have more freedom but also more responsibility. Employees, on the other hand, have more security but less flexibility.

Examples of 1099 Contractors

There are many types of jobs that fall under the 1099 contractor category. Some examples include:

- Freelance writers and editors

- Graphic designers

- Plumbers, electricians, and other skilled trades

- Ride-sharing drivers

- Real estate agents

- IT consultants

- Marketing specialists

Basically, anyone who works independently and is paid by the project or service rather than being hired as a permanent staff member can be considered a contractor.

How Taxes Work for 1099 Contractors

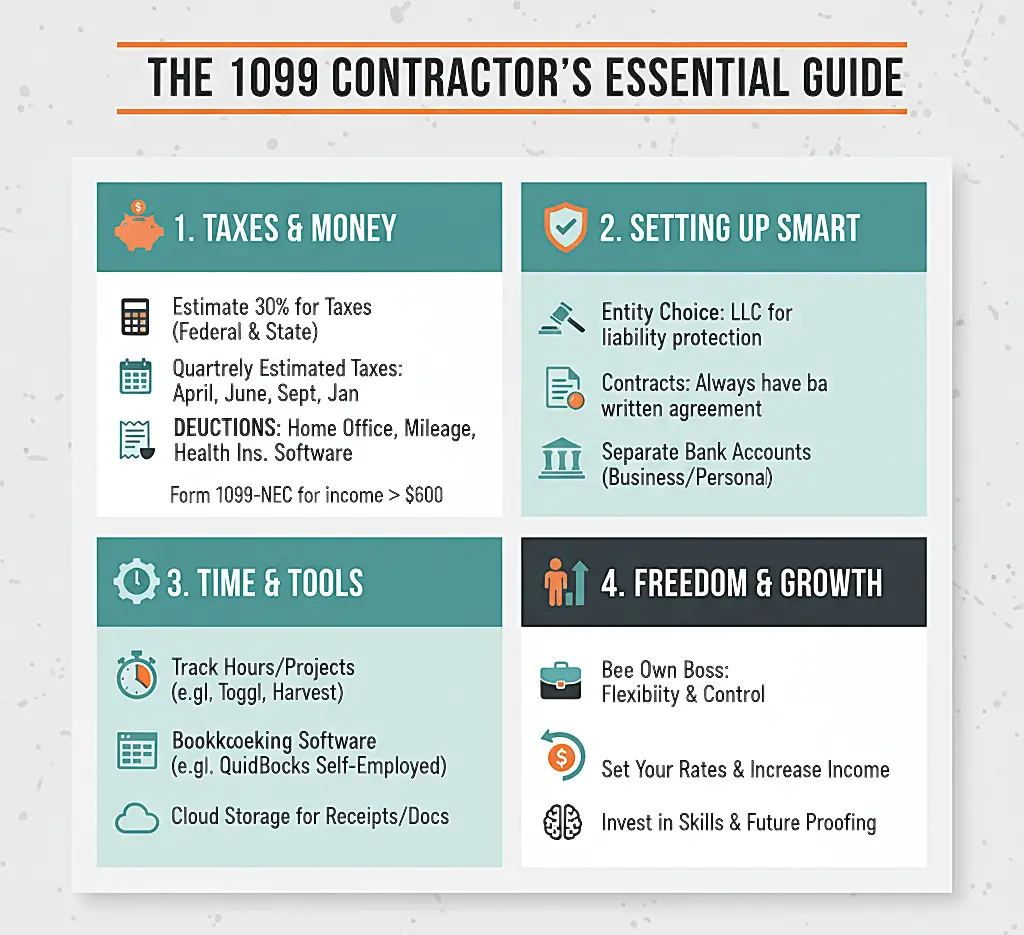

Taxes are one of the most important aspects of being a contractor. Since no employer withholds taxes from your paycheck, you need to manage this yourself. Contractors pay something called self-employment tax, which covers Social Security and Medicare.

For employees, their employer pays half of these contributions, but contractors must pay the full amount themselves. This can be challenging, but it also means you can deduct business expenses like travel, supplies, or a home office from your taxable income.

For example:

- If a freelance designer earns $50,000 in a year but spends $5,000 on equipment and internet, they only pay tax on $45,000.

Advantages of Being a 1099 Contractor

There are several reasons why people choose to work as contractors instead of employees:

- Flexibility in Work Hours – You can decide when and where to work.

- Multiple Clients – You are not tied to one employer. You can work with different companies.

- Control Over Work – You have more control over the kind of projects you accept.

- Tax Deductions – You can deduct expenses like laptops, fuel, office supplies, or software.

- Potential for Higher Earnings – Many contractors charge higher hourly or project rates compared to employees.

Challenges of Being a 1099 Contractor

While there are benefits, contractors also face challenges:

- No Benefits – Contractors usually don’t get health insurance, retirement plans, or paid vacations.

- Tax Responsibility – You must handle your own taxes, which can be confusing without guidance.

- Unstable Income – Work is not always guaranteed. Some months may bring more projects than others.

- No Job Security – Contracts can end anytime, unlike permanent employment.

These challenges mean you need good financial planning and self-discipline to succeed as a contractor.

Who Uses 1099 Contractors?

Both small businesses and large companies hire 1099 contractors. Businesses do this because contractors are often cheaper and more flexible than full-time employees. They don’t have to pay benefits or long-term salaries.

Industries like construction, IT, marketing, and healthcare rely heavily on contractors for specific projects. For example, a company might hire a 1099 web developer to build a website but not keep them as a permanent staff member once the work is complete.

Is Being a 1099 Contractor Right for You?

Deciding whether to work as a 1099 contractor depends on your goals:

- If you want freedom, variety, and independence, being a contractor might be a good fit.

- If you prefer job security, stable pay, and benefits, then being an employee may be better.

It’s also possible to mix both. Some people work a full-time job and also take contract projects as a side hustle.

Key Things Every 1099 Contractor Should Remember

- Keep track of all income and expenses.

- Save money for taxes throughout the year.

- Consider hiring an accountant or using tax software.

- Understand that you are running your own small business, even if you are just one person.

- Build strong relationships with clients for steady work.

Conclusion

A 1099 contractor is not just a worker—it’s someone running their own small business. They are independent, flexible, and responsible for their own taxes and benefits. This role comes with both opportunities and challenges.

If you want to control your own career path, set your own schedule, and work with different clients, then being a 1099 contractor could be the right choice. However, you must also be ready to manage taxes, handle irregular income, and plan for your own financial security.

Also Read:

- IRS Form 5472: Filing Requirements, Rules, and Penalties

- Section 10 of the Income Tax Act

- Section 1 of the Income Tax Act

- Section 54 of Income Tax Act

- How to Register for VAT in UAE

Frequently Asked Questions

What is a 1099 contractor?

A 1099 contractor is a self-employed person who works for a company but is not an employee. They are paid per project, and their earnings are reported using IRS Form 1099-NEC.

1099 vs. W-2: What’s the difference?

W-2 employees have taxes taken out and get benefits. 1099 contractors handle their own taxes (self-employment tax), receive no benefits, and have more control and flexibility over their work.

Do 1099 contractors pay taxes?

Yes. Contractors must pay income tax plus self-employment tax (Social Security and Medicare). Since no taxes are withheld, they must pay these taxes themselves, usually every quarter.

Can a contractor work for multiple clients?

Yes. A major benefit of being a contractor is the freedom to work for several clients or companies at the same time. This allows you to increase your income and gain varied experience.

What are common 1099 jobs?

Any project-based work can be a contractor role. Common examples include freelance writers, graphic designers, IT consultants, real estate agents, electricians, and ride-sharing drivers.

Do 1099 contractors get benefits?

Usually no. Contractors are responsible for their own benefits, such as health insurance, paid time off, and retirement savings. They must arrange and pay for these on their own.

Are contractors eligible for unemployment?

Generally not. Because contractors are self-employed, they do not pay into the traditional unemployment system. Eligibility may be possible only during specific, temporary government programs.

Can a 1099 switch to W-2?

Yes. If a company finds a good fit, they may offer a contractor a full-time, W-2 employee position. This switch would provide benefits and employer-handled tax withholding.