Form 5472 is an information return form used by the Internal Revenue Service (IRS). It is not like a tax return that shows income and tax payments. Instead, it is a reporting tool. The form is required when certain foreign-owned U.S. corporations or U.S. corporations engaged with foreign shareholders have reportable transactions.

This form allows the IRS to keep track of financial activity between U.S. businesses and foreign owners or affiliates. This helps the government monitor international business transactions, prevent tax avoidance, and maintain transparency.

For example, if a foreign company owns a U.S. corporation and that corporation makes a loan, sale, or payment to its foreign owner, the transaction must usually be reported using Form 5472.

Why is Form 5472 Important?

The purpose of Form 5472 is to give the IRS information about business transactions that involve foreign parties. Without this reporting, it would be very difficult for the government to know if companies are following tax laws correctly.

Some key reasons why it is important include:

- It helps the IRS track money flowing in and out of U.S. businesses with foreign ownership.

- It prevents misuse of tax rules, such as hiding income in foreign accounts.

- It provides transparency and fairness in the tax system.

- It ensures that international businesses are treated in the same way as U.S. businesses.

If a required business does not file the form, the IRS can charge heavy penalties. This shows how important it is to follow the rule carefully.

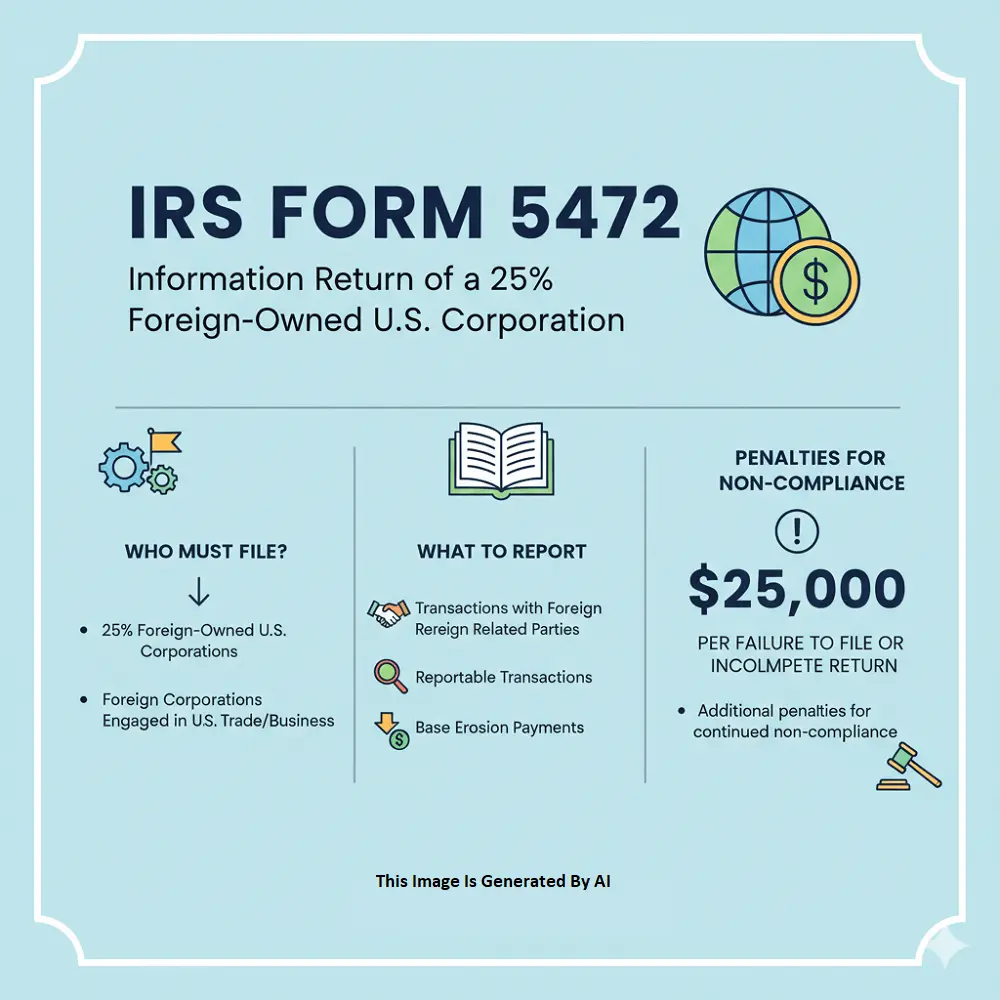

Who Must File Form 5472?

Not all companies in the U.S. need to file this form. It applies to specific cases. Generally, the following businesses are required to file:

- A U.S. corporation with 25% or more foreign ownership.

- If one foreign person or company owns at least 25% of the stock, the corporation usually must file.

- A foreign-owned disregarded entity.

- This means a company that is treated as part of its foreign owner for tax purposes.

- A U.S. corporation involved in reportable transactions with related foreign parties.

What is Considered a Reportable Transaction?

The IRS uses the term reportable transaction for many kinds of dealings. This includes almost any financial activity between the U.S. company and its foreign owner or affiliate. Some examples include:

- Sale of products or services.

- Loans or advances of money.

- Payment of rent, royalties, or license fees.

- Interest payments.

- Capital contributions.

- Other types of payments or transfers of money or property.

The table below shows some common examples:

| Type of Transaction | Example |

|---|---|

| Sale of goods | U.S. company sells products to its foreign parent company. |

| Services provided | U.S. company pays foreign owner for consulting services. |

| Loan or advance | Foreign owner lends money to U.S. company or vice versa. |

| Royalties or license fees | U.S. company pays foreign affiliate for using trademarks or patents. |

| Interest payments | U.S. company pays interest on a loan from a foreign owner. |

These are just examples, but the IRS definition is broad. If there is doubt, it is usually safer to report the transaction.

When Must Form 5472 Be Filed?

Form 5472 is filed together with the company’s annual tax return. For example, if a corporation files Form 1120 (the U.S. corporation income tax return), then Form 5472 is attached to it.

The deadline for filing is the same as the tax return deadline, usually the 15th day of the fourth month after the end of the tax year. For most companies using the calendar year, this means April 15.

However, if a business applies for an extension on its corporate tax return, the deadline for Form 5472 also gets extended.

What Happens If You Don’t File?

The IRS takes Form 5472 very seriously. If a company fails to file it, or files it incorrectly, the penalties can be high. The basic penalty starts at $25,000 for each tax year. If the company continues to not file after receiving an IRS notice, the penalty increases further.

This shows that even though the form may seem like “just information,” it is important to follow the rules correctly. The IRS uses these reports to ensure fair tax practices for both U.S. and foreign-owned businesses.

Difference Between Form 5471 and Form 5472

Many people confuse Form 5471 with Form 5472. Both deal with international ownership, but they are different.

- Form 5471 is used by U.S. citizens or residents who own shares in a foreign corporation.

- Form 5472 is used by U.S. corporations with foreign ownership or transactions.

One reports American owners in foreign companies, and the other reports foreign owners in American companies.

Basic Information Required in Form 5472

The form asks for detailed information about the company and its transactions. Some of the key items include:

- Company name and address.

- Identification number.

- Information about the foreign shareholder.

- Nature of the relationship between the U.S. company and foreign party.

- Details of reportable transactions.

This may sound like a lot, but much of the information is already available in the company’s records.

Why Small Businesses Should Pay Attention

Even small businesses that are foreign-owned should pay attention to Form 5472. Many new business owners assume that small size means exemption, but that is not always true.

For example, if a foreign person forms a single-member LLC in the U.S., it is often treated as a disregarded entity. In that case, it still needs to file Form 5472 even if the business has very little activity.

This shows that compliance is not just for large corporations but also for smaller companies.

How Form 5472 Helps International Business Transparency

Transparency is very important in the global economy. By requiring foreign-owned businesses to report transactions, the U.S. ensures that tax rules are applied fairly. This builds trust and helps maintain healthy international trade.

For instance, International taxation is a subject that affects many countries, and forms like 5472 are one way to keep records clear and accountable.

Conclusion

Form 5472 is an information return required by the IRS for certain foreign-owned U.S. corporations and entities. It is not a tax return but a way for the IRS to track reportable transactions between U.S. companies and foreign parties.

If you own or manage a U.S. corporation with foreign ownership, it is important to understand whether you must file this form. The penalties for not filing are high, but the actual process is manageable with proper records.

Also Read:

- Section 10 of the Income Tax Act

- Section 1 of the Income Tax Act

- Section 54 of Income Tax Act

- How to Register for VAT in UAE

- Income Tax Budget 2025: What’s New?

Frequently Asked Questions

What is IRS Form 5472 and why is it required?

Form 5472 is an IRS information return for U.S. corporations with foreign ownership. It reports financial transactions with foreign owners or affiliates. The IRS uses it to ensure transparency, prevent tax evasion, and track international business activity.

Who must file IRS Form 5472 every year?

Any U.S. corporation with 25% or more foreign ownership must file Form 5472. Disregarded entities owned by foreign persons also need to file. Companies with reportable transactions with foreign affiliates are included. Filing ensures compliance and avoids penalties.

What are reportable transactions in Form 5472?

Reportable transactions include sales, services, loans, rents, royalties, interest, and any financial dealings between a U.S. company and a foreign owner. If unsure, it is safer to report. These transactions are the main reason Form 5472 exists.

What is the deadline for filing IRS Form 5472?

Form 5472 is filed with the company’s annual tax return, usually Form 1120. The standard deadline is April 15 for calendar-year companies. Filing extensions for the tax return also extend the Form 5472 deadline.

What penalties apply if Form 5472 is not filed?

The IRS imposes a $25,000 penalty per year for not filing Form 5472. Continued failure after IRS notices can result in higher penalties. Filing on time is critical to avoid fines and ensure compliance with U.S. tax laws.

How is Form 5472 different from Form 5471?

Form 5471 reports U.S. persons who own foreign corporations. Form 5472 reports foreign owners of U.S. corporations. One tracks Americans owning foreign businesses, the other tracks foreigners owning U.S. businesses. Both ensure proper international tax reporting.

What information is needed to complete Form 5472?

You must provide company and foreign owner details, including names, addresses, identification numbers, and relationships. Reportable financial transactions, like payments or loans, must also be included. Most of this information is already in company records.

Do small businesses also need to file Form 5472?

Yes, even small foreign-owned U.S. businesses may need to file Form 5472. For example, a single-member LLC owned by a foreign person often requires filing, even with minimal activity. Size does not exempt businesses from this IRS requirement.

Can IRS Form 5472 be filed electronically?

Yes, Form 5472 can be filed electronically when attached to Form 1120. E-filing reduces errors, provides confirmation, and speeds up processing. Many businesses prefer electronic filing to meet deadlines and maintain compliance.

How can businesses avoid mistakes on Form 5472?

Keep detailed records of all transactions with foreign owners. Review IRS instructions carefully, use accounting software, and consult tax professionals. Filing on time with accurate details reduces errors, avoids penalties, and ensures full compliance with IRS rules.