With the launch of the Goods and Service Tax on 1st July 2017, India redefined the taxation model with an understanding to merge all indirect taxes like VAT, Service Tax, and Excise Duty under one roof. The GST comes into the arena in four different rates – 5%, 12%, 18%, as well as 28% based on the type of goods or services being provided. In regard to the rental properties, the GST rate has been set as 18%, which affects commercial property rentals. Thus, it excludes residential property rentals from this tax ambit.

What is GST on rental properties, and how does it affect the rental income in general? In this blog, we will see.

Understanding GST on Rent: Key Highlights

- Commercial Properties Rental: GST of 18% is levied on the rental of commercial properties.

- Residential Property Rentals: The latter, residential property rental, shall not be levied with GST unless used for business purposes.

- GST Applicability: GST will be applicable only if annual rental income from commercial property is over Rs. 20 lakhs.

Impact of GST on Rental Income

Before GST, if the rental income is above Rs. 10 lakhs annually, you attract service tax. In this case, 15% on commercial property. No service tax applies to residential property unless it is used for commercial purposes.

After GST, the threshold of applicability of tax has increased to Rs 20 lakhs from Rs 10 lakhs for rental income. Nevertheless, GST is not leviable on residential property used for dwelling purposes. However, an appreciable 18% GST is levied on commercial rentals or while a residential property is leased for any commercial activity.

GST on Rent: Pre-GST vs. Post-GST Rules

Pre-GST Rules

- Requirement of Service Tax: For all their rental income, if the total taxable income exceeded Rs. 10 lakhs a year, owners had to register themselves for service tax.

- Commercial Properties: On earning rent from commercial properties, the service tax might be paid at 15%.

- Residential Properties: If let for residential purposes, there was no service tax, if however, for commercial purposes, the tax is on them.

Post-GST Rules

- Enhanced the threshold: The GST turnover limit for all types of rent or lease has been raised to Rs. 20 lakhs.

- Exemption on Residential Properties: GST on the rent from residential properties as an exemption for housing purposes.

- 18% GST for Commercial Use: An 18% GST applies to commercial use, whether in the form of residential property or a commercial building.

GST on Commercial Property

GST applies to commercial property only if the rental income is Rs. 20 lakhs plus in a year. Even if the property is a residence and is used for business on a lease basis, GST at 18% applies for “supply of service.”

Key points:

- Supply Location: GST will be levied at the location of the property, not where the owner of the property resides. For instance, a person, who lives in Delhi, has rented properties in Chennai for commercial activities. GST will be charged there.

- TDS Deduction: It can be applied if the rental income is more than Rs. 2.4 lakhs in a year.

Key Takeaways on GST for Rental Income

- GST on Commercial Rental Income: It also depends on the commercial rental income. If the annual rental income for your commercial property is more than Rs 20 lakhs a year, then GST will be levied at 18%.

- SGST Applicability: An Applicability of SGST It will apply based on the place of a property owned by the person and not the place where he resides.

- GST Exemption for Low Incomes: Income through Rent Below Rs. 20 Lakhs- Whether from residential property or commercial property, if the earnings from rent are below Rs. 20 lakhs, then GST is exempted.

Conclusion

GST has standardized the tax system of rental incomes, especially commercial properties, by simplifying the tax system that eliminates the complexities of multiple taxes. However, intricacies must be seen in particular scenarios, such as when distinguishing between residential and commercial property types, and how these differ in the application of GST against certain thresholds.

With such GST norms, property owners will be able to comply with the norms to ensure and minimize tax liabilities.

Also Read:

- How to Get a GST Number: A Step-by-Step Guide

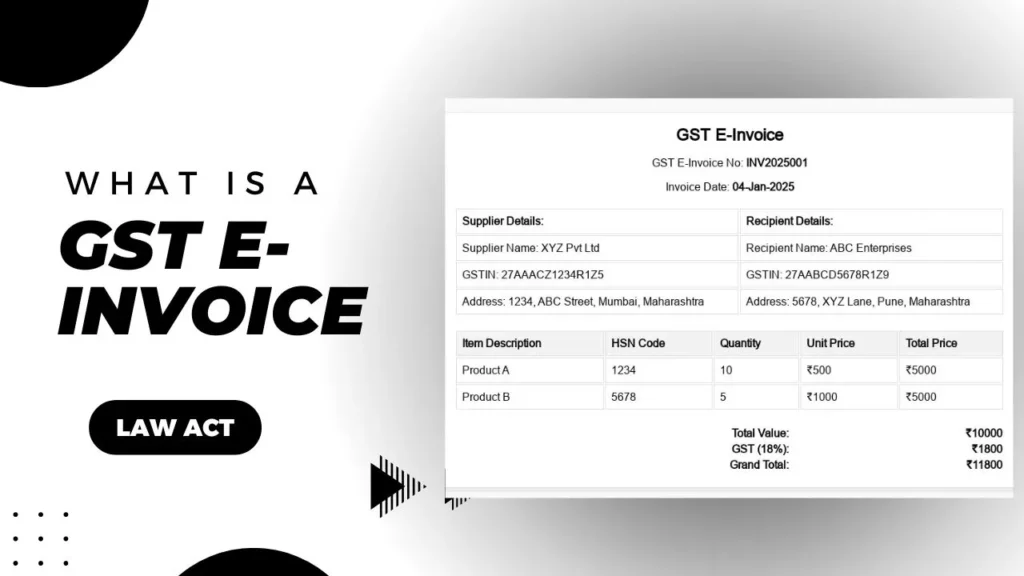

- What is a GST E-Invoice and How Does It Work?

- About GST and Its Impact on the Indian Economy

- How to check GST number: Step-by-Step

Frequently Asked Questions

What is the GST rate on rent income?

The GST rate on rent income is 18%, although that would apply only to the rent so earned from commercial property. GST does not apply to renting of residential properties, which will be used for housing purposes.

Does GST apply to renting residential houses?

No, GST cannot be charged on renting residential properties if they are used for residential accommodation, but when a residential property is rented for a commercial purpose, GST will be levied.

How much is the threshold of GST on rental income?

If the amount of rent collected from a commercial property exceeds Rs 20 lakhs, then GST is applicable. If your rental income is below this limit, then you do not have to pay GST.

How does GST impact renting commercial properties?

If you are renting commercial space and earning more than Rs. 20 lakhs a year, then you would be charged 18% GST for the rental earnings. The entire area of commercial leasing or renting falls in this section.

Is GST charged on renting residential properties for commercial use?

Yes. If a residential property is let for commercial use then GST at 18% would be paid on the rent but only if there is partial letting for business use.

How is GST treated when the owner and property are in different states?

GST will be charged at the location of the property and not the residence of the owner. For example, if you are residing in Delhi and letting out a property in Chennai, then you will incur GST in Chennai.

Do I charge GST on rental income if it is less than Rs. 20 lakhs?

You do not have to pay GST if your rental income from a commercial property is less than Rs. 20 lakhs per year.

What is the change in the GST threshold compared with the old tax system?

Earlier there was a tax called service tax on rental income at Rs. 10 lakhs. GST has pushed the threshold to Rs. 20 lakhs, making it easier for property owners who have low incomes.

Do I need to deduct TDS on rental income under GST?

TDS will be deducted from your rental income in case your annual rental income is more than Rs. 2.4 lakhs. However, if on the whole, you don’t have tax liability on the total income, then you can submit Form 15H or 15G to the bank. This way, TDS will not be deducted from your account.

What are the benefits of GST on rental income?

GST has simplified taxation as one integrates several taxes into one. They have made it easy for tax payments on property for its owners, more especially in terms of the rental income threshold that has increased from Rs. 10 lakhs to Rs. 20 lakhs.