In the United States, tax adoption usually refers to the Adoption Tax Credit, a federal tax benefit for parents who adopt a child. This credit helps reduce the cost of adoption by letting parents claim certain adoption-related expenses on their tax return.

The goal of tax adoption is to make adoption easier and more affordable for families. Adoption can be expensive, and the tax credit helps reduce the financial pressure on parents.

What Is the Adoption Tax Credit?

The Adoption Tax Credit is a tax credit offered by the IRS to help families cover adoption costs. When parents adopt a child, they can claim qualified expenses on their tax return and reduce the amount of tax they owe.

In simple words:

If you adopt a child, you can get money back by claiming your adoption costs on your taxes.

This applies whether you adopt a baby, an older child, or a child from foster care. The credit amount changes each year due to inflation.

Why the Adoption Tax Credit Matters

The cost of adoption can be high, and many families worry about the expenses. The adoption tax credit helps families manage costs related to:

- Court fees

- Attorney fees

- Home study fees

- Agency charges

- Travel expenses

- Medical costs related to adoption

- Other required adoption expenses

The credit makes adoption more affordable and encourages more families to adopt children who need permanent homes.

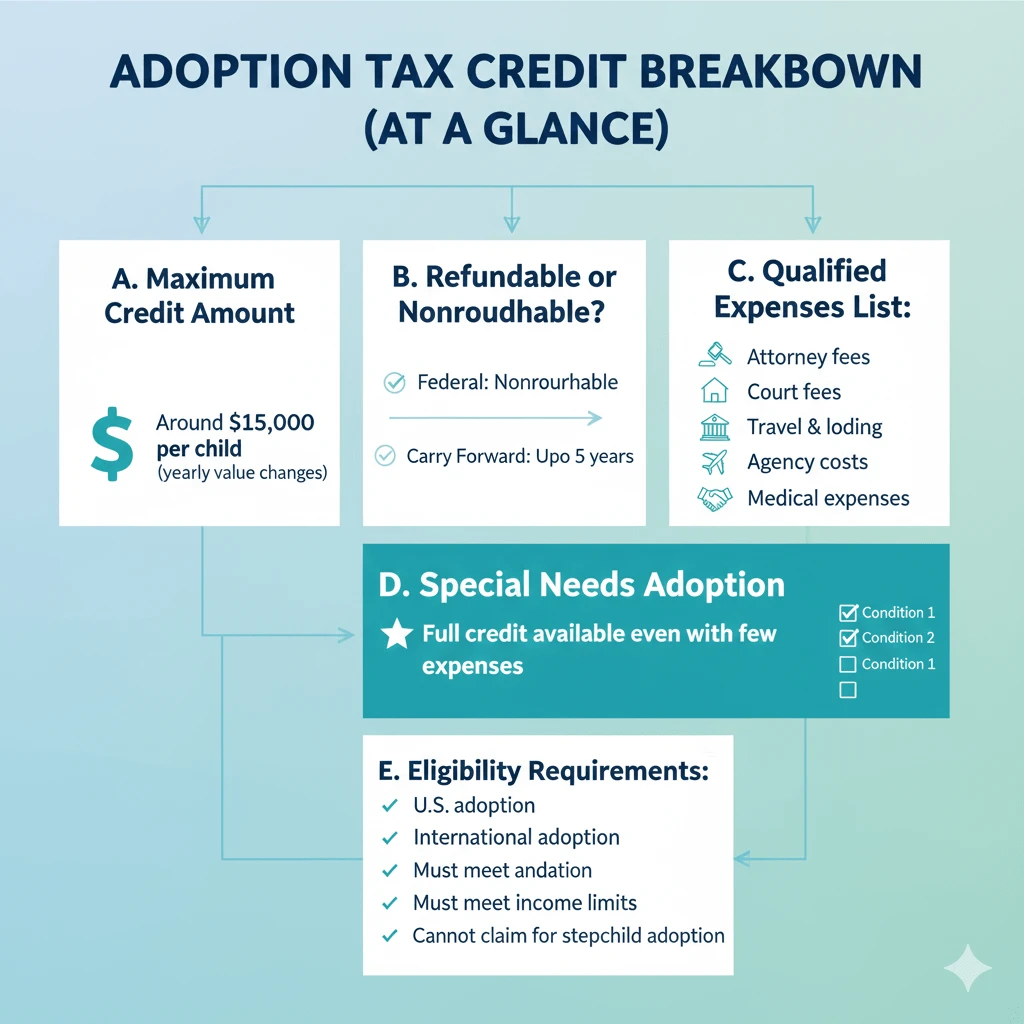

How Much Is the Adoption Tax Credit?

Each tax year, the IRS sets a new limit for the credit. Although the exact amount changes, it usually falls between $14,000 and $16,000 per child.

To help you understand better, here is a sample table showing how the credit amount works:

| Tax Year | Maximum Credit Per Child | Refundable? |

|---|---|---|

| Example Year | Around $15,000 | No (Nonrefundable) |

The credit is nonrefundable, which means:

You cannot get more money back than the amount of tax you owe.

But you can carry forward the unused credit for up to five years.

Adoption Tax Credit Details

The IRS updates the adoption tax credit each year to help families manage the cost of adoption. Below is the most recent and complete information, including the maximum credit, income limits, and refundability rules.

| Tax Year | Maximum Credit Per Child | Income Phase-Out Range (MAGI) | Refundability Status |

|---|---|---|---|

| 2024 | $16,810 | $252,151 – $292,150 | Nonrefundable (can be carried forward for up to 5 years) |

| 2025 | $17,280 | $259,191 – $299,190 | Partially refundable (up to $5,000) |

| 2026 | $17,670 | Starts at $265,080 and ends at $305,080 | Partially refundable (up to $5,120) |

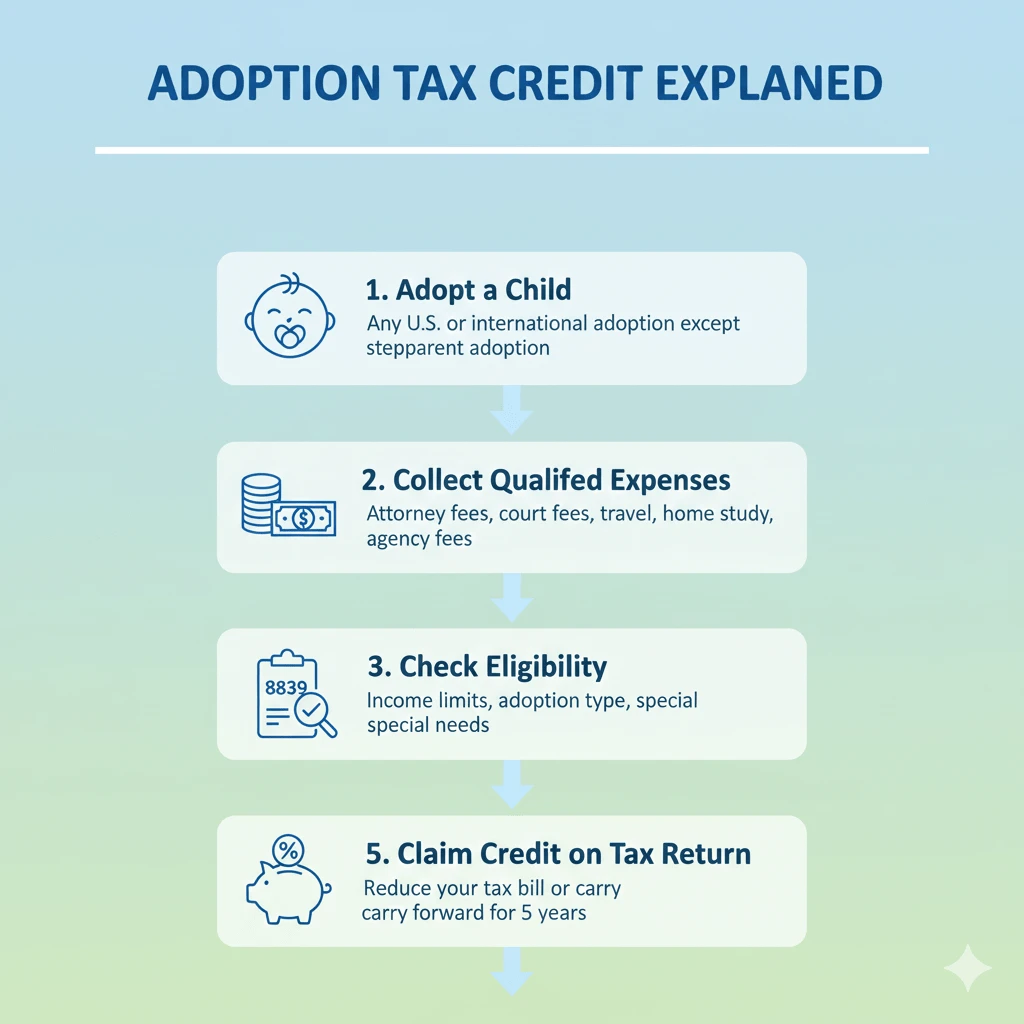

Who Qualifies for the Adoption Tax Credit?

Not every adoption qualifies for the credit, but most do. You may qualify if:

- You adopted a U.S. child

- You adopted a child from another country

- You adopted through private, agency, or foster care

- You paid qualified adoption expenses

- You meet income limits set by the IRS

There is also a special rule for children with special needs. Parents who adopt a child officially classified as having special needs may qualify for the full credit amount, even if they paid little or no adoption expenses.

What Counts as Qualified Adoption Expenses?

The IRS allows many expenses to be included. These are costs directly related to the adoption process, such as:

- Adoption agency fees

- Attorney and legal fees

- Court costs

- Home study fees

- Reasonable travel expenses

- Meals and lodging during adoption travel

- Adoption counseling services

- Related medical expenses

Expenses paid before and after the adoption may also qualify if they are directly connected to the adoption.

What Does Not Qualify?

Some expenses cannot be claimed. These include:

- Costs paid using employer adoption benefits

- Expenses to adopt a spouse’s biological child

- Unlawful, illegal, or non-approved expenses

- Fees paid for surrogate parenting

Understanding what is allowed and not allowed helps avoid mistakes when filing taxes.

Income Limits for the Adoption Tax Credit

The Adoption Tax Credit has income rules. If your income is above a certain level, your credit amount may be reduced.

The IRS reviews your Modified Adjusted Gross Income (MAGI) to decide how much you can claim. If your income is too high, you may receive only part of the credit or none at all.

These limits change every year, but the general idea remains the same.

How To Claim the Adoption Tax Credit

Claiming the credit is simple if you follow the correct steps. Parents must fill out a special IRS form called:

Form 8839 — Qualified Adoption Expenses

Here is how the process works:

- Collect all adoption-related documents

- Add up your qualified expenses

- Fill out Form 8839

- Attach it with your federal tax return

- Keep all receipts and records in case the IRS asks for proof

If the adoption is not yet final, you may still claim certain expenses depending on the year they were paid.

Is the Adoption Tax Credit Refundable?

The Federal Adoption Tax Credit is nonrefundable, which means:

- You can reduce your tax bill to zero

- But you do not get extra money back if the credit is more than your tax

However, unused credit can be carried over for up to five years.

Some states offer additional adoption tax benefits, and a few are refundable, meaning parents can get more money back.

What Is a Special Needs Adoption Credit?

If you adopt a child classified as having special needs, you may qualify for the full tax credit amount, even without having paid large expenses.

A child is considered “special needs” if:

- They are a U.S. citizen or resident

- The state decides they cannot or should not return to their birth parents

- The state decides the child needs assistance to be adopted

This benefit encourages more families to adopt children who need the most support.

Can I Claim the Credit for International Adoption?

Yes, international adoptions qualify. However:

- The adoption must be fully completed

- You can only claim expenses after the adoption is final

- Foreign rules and documents must be valid

The IRS may request extra documentation for international adoptions.

Can Two Parents Claim the Credit?

Married couples must file jointly to claim the credit.

If two parents adopt together, they must share the expenses appropriately, but only one tax return can apply for the credit.

Conclusion

Tax adoption, or the Adoption Tax Credit, is one of the most helpful tax benefits available to families who adopt a child. It reduces financial stress, supports adoptive parents, and encourages more families to provide stable homes for children in need.

By understanding how the credit works, who qualifies, and how to claim it, families can save thousands of dollars during the adoption process. This simple guide explains everything in clear language so you can make informed decisions and feel confident when filing your tax return.

Also Check:

- Commissioner of Income Tax Meaning and Role

- Explore All About 1099 Contractor

- IRS Form 5472: Filing Requirements, Rules, and Penalties

- Section 10 of the Income Tax Act

- Section 1 of the Income Tax Act

- Section 54 of Income Tax Act

- The Comptroller of Income Tax Addresses

Frequently Asked Questions

How much tax credit do adoptive parents get?

The adoption tax credit amount changes every year, but adoptive parents generally receive a credit of around fifteen thousand dollars per child. This credit helps reduce the amount of federal income tax they owe. Parents can claim qualified adoption expenses, and if the credit is more than their tax bill, they can carry the remaining amount forward for up to five years. The purpose of this credit is to make adoption more affordable for families in the United States.

What expenses count for the adoption tax credit?

Qualified adoption expenses include many costs directly related to the adoption process. These can include court fees, attorney charges, home study costs, adoption agency fees, and required travel expenses. Meals and lodging during adoption travel may also count. Medical expenses related to the child’s adoption may qualify too. The IRS allows expenses that are necessary, reasonable, and directly connected to the legal adoption of a child.

Is the adoption tax credit refundable?

The federal adoption tax credit is currently nonrefundable, which means it can only reduce your federal income tax to zero and cannot give you a refund beyond the tax you owe. However, if your credit is larger than your tax bill, you may carry the unused portion forward for up to five years. Some states offer additional refundable adoption credits, but this depends on where you live. The main goal is to reduce adoption costs for families.

How do I fill out IRS Form 8839?

To fill out Form 8839, you need to list your qualified adoption expenses and provide details about the child you adopted. You will enter your expenses on the form and calculate the amount of credit you can claim. You then attach Form 8839 to your federal tax return. It is important to keep all receipts and documents related to the adoption in case the IRS asks for proof. The instructions included with the form can help guide you step-by-step.

Do foster parents qualify for the adoption tax credit?

Foster parents qualify for the adoption tax credit only when the foster child is legally adopted. Caring for a child in foster care alone does not qualify. Once the adoption becomes final, parents may claim eligible expenses. In many cases, adoptions through foster care involve lower costs, and parents adopting a child with special needs may be eligible for the full credit even without large expenses. This helps support families who choose to adopt through the foster care system.

What about special needs adoption?

Special needs adoption offers additional support through the adoption tax credit. If a child is officially classified by the state as having special needs, the adoptive parents may qualify for the full credit amount, even if they had little or no adoption expenses. The child must be a U.S. citizen or resident, and the state must determine that the child is not able to return to their birth parents. This credit encourages more families to adopt children who need extra help and a permanent home.

Are international adoptions covered by the adoption tax credit?

Yes, international adoptions can qualify for the adoption tax credit, but there are special rules. The adoption must be fully completed before parents can claim the credit. Expenses paid before completion cannot be claimed until the adoption is final. Parents must also follow foreign adoption regulations and keep all documents, as the IRS may request additional proof. The credit helps families manage the higher travel and legal costs involved in international adoption.

What are the income limits for the adoption tax credit?

The adoption tax credit has income limits based on your Modified Adjusted Gross Income (MAGI). If your income is within the allowed range, you can claim the full credit. If your income is higher, the credit amount begins to phase out. Very high incomes may not qualify at all. The limits change each year due to inflation adjustments. These rules ensure that the benefit supports families who need financial help with adoption costs.