We were to think about the financial plans such as the Account BC Plan, we think of the detailed strategy that a business or organization follows to manage its money. The critical importance of such plans is that they will assure the company of spending its money properly, saving where possible, and the company will attain its financial goals, but who has the last say? In this blog, we’ll run through the process and identify who or which group is the key person/group to provide that final approval. Before getting into who approves the plan, let’s first understand what the Account BC Plan is.

What is an Account BC Plan?

An Account BC plan is an assessment of a business’s financial plan controlling the budget, spending, and resources. It contains projections for revenues, which is money coming into any business; expenses, which are money going out; and investments, which are long-term projects on which one saves or spends money. Such a plan aids in running the business smoothly, meeting the financial obligation, and investing further into growth.

Why is an Account BC Plan Important?

An Account BC Plan is important for a number of reasons. Some of the reasons include the following:

- Budget Management: Helps the company distribute its money in the right places.

- Financial Health: Ensures that the company is liquid and might not default against its bills.

- Goal Setting: Helps in the formulation and achievement of set financial goals.

- Risk Management: Identifies and minimizes financial risks.

- Performance Tracking: Monitors financial performance against set targets.

Role of the Final Approver

The final approver of an Account BC plan is normally a senior executive or a team of senior executives within an organization. The final approver can be of very great importance to him, as he is the one who finally gives the Business Continuity plan a go-ahead, thereby making it active, valid, and applicable. Final approval is not just stamping of authority; it means that the plan has been reviewed with complete satisfaction and is thus full and workable.

Final Approver Responsibilities

- Review and Authenticity: The final approver has to review the BC plan and ensure that every crucial aspect of business continuity is addressed. Every possible threat is to be identified and a process for the mitigation or control of each developed, along with an optimal recovery plan for each.

- Compliance Checking: The final approver has to check to make sure that the BC plan complies with the laws, regulations, and relevant industry standards. This is important in a highly regulated area, especially finance and healthcare.

- Resource Allocation: Approval of the respective BC plan means approving more often than not that the right resources, such as budget, people, and technology, are availed in the first place to sustain the plan during implementation and its maintenance.

- Approval and Communication: The final approver must approve of the BC plan and communicate its significance to all employees. This approval shall diffuse the culture of readiness to the people and let everyone know what to do in the event of a disruption.

Approval Process

Development of the Account BC Plan will entail a few processes and a few people. Here is a simplified breakout of the process:

- Planning: Financial experts and department heads outline the initial plan, which speaks to the expected revenues, expenses, and investments.

- Reviewing: The initial plan is distributed to various levels for reviewing and ensuring that it covers all aspects of the business and contains only realistic projections.

- Adapting: The plan is subsequently adapted to include changes.

Approving: The final step is the highest level of authority in the company passing the plan.

Also Check: Trade Expenses in Final Accounts

Who Approves the Plan?

Main Participants: These are some of the key participants that are required in the approval process. Department Heads are the supposed approvers of the plan: they scrutinize it against their departmental needs. The Finance Team: ensures the numbers are right and the plan is sound on its face. The Executive Team must review the overall strategy of how the plan supports the company’s goals. Final Approver: The Decision Maker.

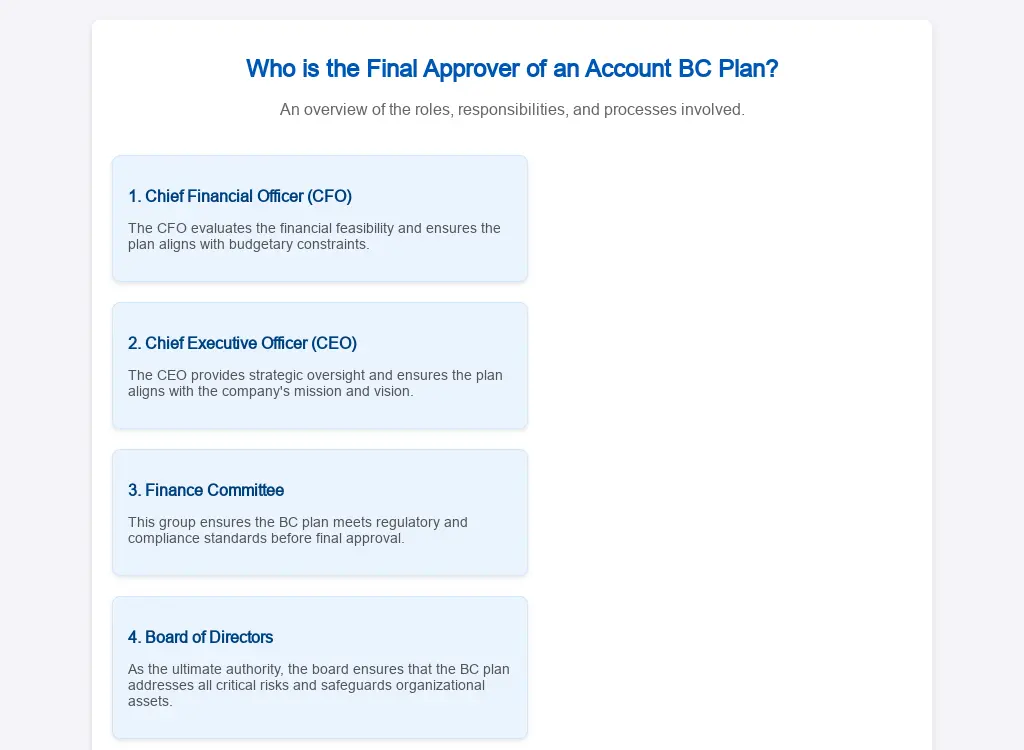

Chief Executive Officer: In most companies, this person is the final approver of the Account BC Plan. Let’s see who this might be:

1. CFO:

As a rule of most of the companies, the CFO is the final approver for this. This is because the CFO is the responsible one for the financial health of the company and supervises the financial planning and analysis. He also ensures that the plan looks realistic, is entirely supporting the financial goals of the company, and there are no violations against any regulatory requirements.

Why CFO

- Expertise: The CFO possesses the amount of financial acumen that can understand plans such as the one to be addressed here.

- Responsibility: They are responsible for the financial health of the company.

- Strategic Vision: The CFO will make sure that the whole plan is in the right alignment with the overall company strategy.

2. Chief Executive Officer (CEO):

In some organizations, the CEO might be the last approver. The chief executive officer is the top-ranking executive officer entitled to look after the overall functioning and performance of the corporation.

Why CEO?

- Ultimate Responsibility: The CEO has a stake in the success of the corporation.

- Strategic Alignment: The CEO makes sure that the plan is in alignment with the corporation’s vision and company strategy.

- Leadership: The CEO provides the final sign-off to show ownership in the plan.

3. Board of Directors:

In larger companies, especially publicly traded ones, this can be the last approver. The Board of Directors is a group of people elected to represent the shareholders to provide overall direction and management guidance.

Why the Board of Directors?

- Oversight: They can offer oversight and ensure in the best interest of the shareholders.

- Governance: They make sure that the plan adheres to corporate governance practices.

- Accountability: The Board makes the management answerable to the implementation of the plan.

4. Finance Committee:

Few companies have a Finance Committee, which is considered a subcommittee of the Board of Directors, for the Financial Supervision. That committee appraises and endorses the financial plan and sends the same to the Board of Directors to get their final approval.

Why the Finance Committee?

- Specialist Control: They have the know-how to analyze the financial information.

- Concentrated Appraisal: They appraise it properly before the approval of the full Board.

- Efficiency: This can expedite the process of approval

The Approval Meeting

When the plan is ready, then a meeting is called for the final approval. The following is the usual systems in such meetings:

- Presentation: The finance team or CFO will present the plan, underlining its salient features, assumptions, and projections.

- Discussion: People involved discuss, ask questions, give feedback on the plan

- Decision: The final and conclusive decision is made by the highest approver possible, which could be the CFO, CEO, Board, or Finance Committee the approval of the final decision can either be an “Approved”, “Request for Changes,” or “Rejected.”

Essential points to be considered for approval

There are a few areas that ought to be taken care of before the BC Account Plan is approved:

- Accuracy: Are the financial projections and assumptions done in the right manner and are realistic and accurate?

- Alignment: whether the plan aligns with the strategic goals and vision of the company.

- Risk Management: Are financial risks identified and mitigated according to the plan?

- Compliance: Does the plan meet all regulatory requirements and standards of corporate governance?

- Impact on Stakeholders: What impact will the plan have on shareholders, employees, customers, and all other stakeholders?

Why Ultimate Approval Is Crucial

The final approval is paramount in that it links the plan with the commitment of the company. It also dictates that the highest authority in this company has gone through, scrutinized, and approved the plan. This thereby gives the employees, the investors, and other stakeholders assurance that the company is on the correct path.

Challenges involved in the Approval Mechanism

The approval mechanism may be faced with the following challenges :

- Complexity: Financial plans can be complex in nature, and going through every detail for review and understanding may be a task in itself.

- Conflicting Priorities: Various departments will have priorities that at times will conflict with each other and result in disagreements.

- Changing Conditions: Economic and market conditions can also change and alter the assumptions and projections made in the plan.

- Regulatory Requirements: Compliance with regulatory requirements is another hurdle to get over.

Overcoming Challenges

Companies can do this by:

- Simplify: The plan should be clearly and concisely presented and key points underlined.

- Coordinate: Coordinate with other departments in collaboration to work on priority-based work.

- Adjust: Be flexible and ready to adjust plans and priorities as conditions evolve.

- Ask: Check in to seek the consultation of experts from legal and regulatory authorities for the compliance check.

Conclusion

The last approver for the Account BC plan thus becomes highly essential for the success and the well-being of the finances of a company. That person or committee—whether CFO, CEO, Board of Directors, or Finance Committee—brings the oversight, expertise, and strategic vision to give a plan the go-ahead that will meet the interests of the company and achieve long-term success. With this knowledge of how the approval process works and these critical considerations, companies should be able to formulate and execute financial plans that drive growth, manage risks, and accomplish the objectives of the respective businesses.

Also Read:

- Trade Expenses in Trial BalanceUnderstanding financial terms is important for every business owner, student, or anyone interested in accounting. One such term is “Trade Expenses”, especially when it appears in the trial balance. This blog will explain what trade expenses are and what their… Read more: Trade Expenses in Trial Balance

- Legal Charges in Final AccountsWhen preparing final accounts for a business, one important topic that often confuses people is legal charges. These charges are not just legal fees or penalties. They have a specific meaning in accounting and finance. In this blog, we will… Read more: Legal Charges in Final Accounts

- Realisation Account FormatManagement of finances is always a must in any business, regardless of how large or small the business might be. Among the key tools in accounting is the Realisation Account. It is especially used in the process of winding up… Read more: Realisation Account Format

- Motive Power in Final AccountsMotive power in final accounts refers to the expenses related to the energy or power needed to run the machinery and equipment. Besides, the manufacturing or production-related industries are usually where these costs are found. Motive power expenses can include… Read more: Motive Power in Final Accounts

- Common Final Accounts Problems and How to Solve ThemAre you facing any final accounts problems? Then this blog is for you, here we will explain how you can solve those problems. By going through this article you can solve issues like incorrect trial balance, missing documentation, and many… Read more: Common Final Accounts Problems and How to Solve Them

Frequently asked questions

Who is the Final Approver of an Account BC Plan?

Final approval of the BC account plan normally falls under the slot of a senior manager or executive within a company. He is the person who has to see everything that is within the plan meets the company’s standards and goals.

What role does the final approver play in BC account plans?

The final approver will check the BC account plan for completeness and accuracy, ensuring that it aligns with the company’s objectives, give the final go-ahead, and make sure everything is ready for implementation.

Why is a final approver needed for the BC account plan?

A final approver is needed to ensure the plan is complete, accurate, and according to the company’s requirements. They avoid possible errors and ensure that the plan works effectively to the company’s advantage.

What qualifications must the final approver have?

The final approver needs to have full knowledge of the company’s goals, experience in strategic planning on business matters, and the skill and ability to make effective decisions. There should be knowledge of the BC account plan details.

Can the final approver delegate their responsibilities for BC account plans?

While the final approver may further delegate some things, this does not clear him of his final commitment to approval. He will still need to ensure that everything delegated was done right and that he has seen the final plan through.

How does the final approver impacts the BC account plan?

The final approver impacts the BC account plan in respect to quality and alignment to company goals and objectives. Their approval signifies that the plan is ready to be implemented and trusted to bring about results as desired.

How is the final approver chosen for a BC account plan?

The final approver is normally a choice that stems from the role, expertise, and experience in a company. It is usually held by senior managers or any other executives who understand the objectives of the company.

What steps does the final approver follow for approval?

They review the entire plan, checking on its accuracy and ensuring that the goals set by the company are in agreement. Some will require revisions before finally approving it.

How does the final approver ensure compliance with BC plans?

The final approver will review the plan against company policies, and legal, and industry standards of compliance. He can consult with legal or compliance teams to confirm everything is in order.

What happens if the final approver rejects a BC account plan?

Should the BC account plan be rejected by the final approver, it is returned for revision. The team would address the issues that have been identified by the approver and make necessary changes before resubmission for approval of the plan.