Management of finances is always a must in any business, regardless of how large or small the business might be. Among the key tools in accounting is the Realisation Account. It is especially used in the process of winding up or selling a business. But what is a realisation account exactly? And how do you properly format one? Let’s break it down for you.

What is a Realisation Account?

A Realisation Account is started when the company decides to dissolve, merge, or sell off its assets. It is useful in determining whether profit or loss has been incurred in the selling of assets, liquidation of liabilities, and distribution of the balance among partners or shareholders.

In other words, it marks the last step of financial travel of any business enterprise and indicates the value of what is sold and how it’s spread.

Why Do You Need a Realisation Account?

During the winding up of any business, all things that happen to the assets and liabilities of that business should be tracked clearly. The Realisation Account helps in:

- Selling off Assets: Under this procedure, all assets of the business are valued at their book value and amounts realized from their sales are recognized.

- Settling Liabilities: The process of dissolution also includes setting off liabilities, which amounts to those liabilities cleared during the period.

- Calculating Profit or Loss: It helps a company find whether it earned profit or incurred loss while disposing of its assets and liabilities.

- Distribution: The remaining amount shall be distributed to partners, shareholders, or creditors.

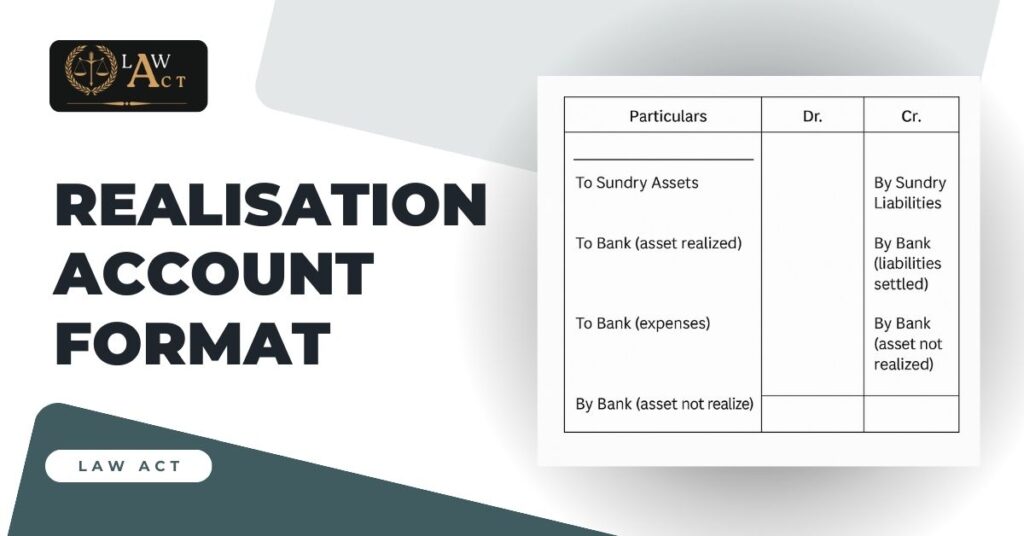

Realisation Account Format

Here’s a simplified structure for the Realisation Account format:

| Particulars | Amount (Dr) | Amount (Cr) |

| To Assets (Transferred from the Balance Sheet) | xxx | xxx |

| – Plant & Machinery | xxx | xxx |

| – Furniture | xxx | xxx |

| – Investments | xxx | xxx |

| To Sundry Debtors | xxx | xxx |

| To Cash/Bank A/c (Sale of Assets) | xxx | xxx |

| To Realisation Expenses | xxx | xxx |

| By Liabilities Settled: | xxx | xxx |

| – Creditors | xxx | xxx |

| – Bank Loan | xxx | xxx |

| By Profit on Realisation | xxx | xxx |

| By Loss on Realisation | xxx | xxx |

Steps to Prepare a Realisation Account

- Transfer Assets to Realisation Account: All assets of the business, other than cash and bank balances, are transferred to the debit side of the Realisation Account at book value.

- Record Sale of Assets: When the assets are sold, record the proceeds on the credit side. If assets are sold at a price higher than their book value, the difference will result in a profit, and if lower, it will lead to a loss.

- Transfer Liabilities: Similarly, transfer all liabilities (except partner liabilities) to the credit side of the account.

- Settle Liabilities: Once settled the cost of these liabilities is accrued and is debited to the Realisation Account.

- Account for Realisation Expenses: Any expenditure incurred in the process of dissolving the company, like legal and auction charges, etc., should be charged on the debit side.

- Profit or Loss on Realisation: Lastly, the difference on both sides provides you with either a profit or loss. If credit overshadows debit then it is a profit and vice versa. This amount is passed on to the capital accounts of partners in case of partnerships.

Key Points to Remember:

- The account of Realisation includes only those assets and liabilities that have been brought into the business’s liquidation.

- It doesn’t constitute personal liabilities of a partner or cash in hand/bank as these are taken care of on an individual basis.

- The account pushes on with the just settlement of all parties, which provides transparency in the process of winding up the business.

Conclusion

A realisation account is of specific importance for companies being wound up or restructured. The figure depicts how properly the assets and liabilities are monitored. It also facilitates the determination of the final profit or loss while the process of dissolution is executed. Keeping the format proper with a Realisation Account will ensure business entities deal with the winding up of the affair in an organised and answerable manner.

Therefore, the structure aids a businessman to be more open on the financial aspect of shutting down or selling the business. All the aspects of finance are brought into sharp focus before the owner himself, his partners, and the creditors.

Also Read:

- Trade Expenses in Final Accounts

- Applicability of Accounting Standards

- Establishment Expenses in Final Accounts

- Motive Power in Final Accounts

- Common Final Accounts Problems and How to Solve Them

Frequently Asked Questions

What is a Realisation Account?

A Realisation Account is opened during the liquidation of a business. It helps to record asset sales as well as liabilities paid and find profit or loss in those incomes.

At what time is the Realisation Account opened?

A Realisation Account is requested at the time when a company is going to be dissolved, merged with another or sold. This is, above all, for the final phase of operations, for instance, selling off assets and paying off debts.

In what way does a Realisation Account differ from a Profit and Loss Account?

It clearly shows the income earned by the business in addition to the expenses of the business incurred in the day-to-day activities of the business. Realisation Account ensures that at the time of closing the business all the sales of assets and liabilities are set off.

What are the main elements of a Realisation Account?

The major components of a Realisation Account comprise assets sold, liabilities discharged, winding-up expenses, and final profit or loss made at the time of closing of business.

From where comes the profit or loss in the Realisation Account?

The profit or loss is determined by comparing the total value of the assets sold with the total amount of liabilities and expenses settled. If the former exceeds the latter, it is a profit; otherwise, a loss.

What happens when all the assets are sold and liabilities are settled?

Any balance is apportioned among the partners, shareholders, or creditors based on the nature of the concern in the Realisation Account after all liabilities are paid.

What costs get accounted for in the Realisation Account?

Appropriate costs that can be incurred in connection with liquidation, like attorneys fees, broker sales costs, or brokerage paid to liquidate the firm assets, should be reflected in the Realisation Account

Why do we require the Realisation Account?

It ensures a transparent process during the closure of the business, tracking the sale of assets, settlement of liabilities, and distribution of funds in the protection of each person’s interest.

Can I create a Realisation Account myself, or do I need an accountant?

Yes, you can prepare a Realisation Account without a professional accountant. In such scenarios, with the complexity of the business closure, it would be advisable to seek an accountant or financial advisor to ensure the accuracy of the realization account.

What happens in case there is a loss in the Realisation Account?

In case of a loss, that means the business sold for less than its book value or had more liabilities as compared with assets. The loss is split among partners or shareholders in ratios predetermined by them.