Any student who is studying for Chartered Accountancy Intermediate or CA Inter should, therefore, be well-versed in the subject of accounting standards for CA Inter. The standards are the core around which the whole financial reporting framework is framed. It makes sure that accounts are homogenous, transparent, clear, and accurate. Hence, it becomes very paramount to learn the most important accounting standards for CA Inter that every student studying for CA Inter should know. Below, the focus will lie on understanding those standards and their applicability in practical situations.

How Important are Accounting Standards for CA Inter?

Accounting standards are the authoritative guidelines that prescribe consistency in financial reporting, as enjoined by the regulatory bodies. For CA Inter students, it is very important to have a proper understanding of these standards, since they constitute a considerable part of the examination syllabus and are also essential for practical application in professional practice.

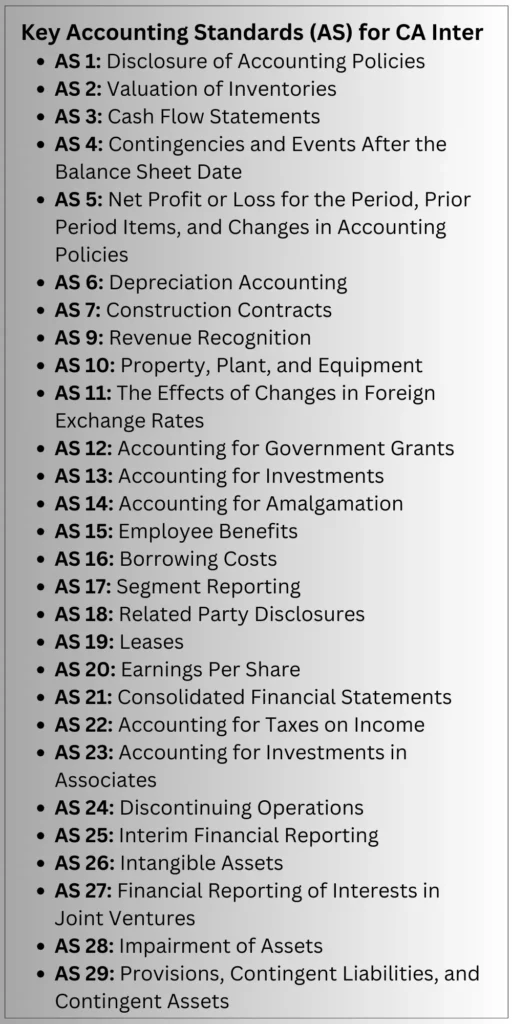

Key Accounting Standards for CA Inter

AS 1: Disclosure of Accounting Policies

Overview: It requires that all significant accounting policies followed in the preparation and presentation of the financial statements be disclosed.

Importance: It brings transparency, helping the user in knowing on what basis the financial statements are prepared.

AS 2: Valuation of Inventories

Overview: This standard deals with the determination of the value at which inventories shall be carried in the financial statements.

Importance: Proper valuation of inventories is important for determining the correct profit or loss for a period.

AS 3: Cash Flow Statements

Overview: AS 3 requires that cash flow statements be prepared and reporting of cash flows during the period be classified under operating, investing, and financing activities.

Importance: Cash flow statements give an insight into the liquidity and financial flexibility of a company.

AS 4: Contingencies and Events Occurring After the Balance Sheet Date

Overview: This standard deals with the treatment of accounting for contingencies and events occurring after the balance sheet date but before the approval of financial statements.

Importance: It will ensure that all material events are taken into account to present a true and fair view of the financial position.

AS 5: Net Profit or Loss for the Period, Prior Period Items, and Changes in Accounting Policies

Overview: AS 5 prescribes the classification and disclosure of extraordinary and prior period items and the changes in accounting policies.

Importance: Consistent application and disclosure of accounting policies enhance the comparability of financial statements over time.

AS 6: Depreciation Accounting

Overview: This standard deals with the systematic allocation of the depreciable amount of an asset over its useful life.

Importance: The importance is that the proper accounting of depreciation should be done so that the value of assets and related expenses and fully expressed in the book of accounts.

AS 7: Construction Contracts

Overview: According to AS 7, the guideline is issued so that revenue and costs relating to construction contracts are properly accounted for.

Importance: It ensures that the financial results of construction contacts are appropriately recognized in that contact

AS 9: Revenue Recongnition

Overview: This standard identifies the requirement for recognition of revenue from the sale of goods, rendering of services, and use of others’ resources.

Importance: Proper recognition of revenue is very important for the proper presentation of the true and fair view of the company’s performance.

AS 10: Property, Plant, and Equipment

Overview: This AS 10 prescribes accounting treatment of property, plant, and equipment and deals with the initial recognition, subsequent expenditure, and disposal of the same.

Importance: Proper accounting of fixed assets are very essential to present the correct financial position.

AS 11: The Effects of Changes in Foreign Exchange Rates

Overview: The standard deals with accounting for transactions in foreign currencies and translating financial statements of foreign operations.

Importance: This standard ensures that any financial impact of changes in the exchange rates will be accurately reflected in the financial statements.

AS 12: Accounting for Government Grants

Overview: AS 12 states the accounting treatment for government grants and the disclosure of such grants in financial statements.

Importance: Proper accounting of government grants is very important for the proper representation of the financial position and performance.

AS 13: Accounting for Investments

Overview: The standard provides guidelines for the classification and measurement, as well as recognition, in accounting for investments.

Importance: Prudent and accurate accounting for investments will ensure that the financial position and performance of the company are fairly and properly reflected.

AS 14: Accounting for Amalgamation

Overview: It deals with the accounting treatment of amalgamation and treatment of resultant goodwill or reserves.

Importance: It ensures comparability and consistency in the financial statements of companies that have gone through amalgamation.

AS 15: Employee Benefits

Overview: This standard prescribes accounting treatment as well as disclosure of different kinds of employee benefits, which include short-term, post-employment, and other long-term benefits.

Importance: Proper accounting for employee benefits is essential for giving a fair presentation of the financial position and compliance with statutory requirements.

AS 16: Borrowing Costs

Overview: AS 16 guides the accounting treatment of borrowing costs, laying down the criteria for capitalization of such costs.

Importance: Proper accounting for borrowing costs will ensure that the financial statements truly reflect the cost of financing.

AS 17: Segment Reporting

Overview: This standard requires the disclosure of financial information concerning various business segments of an enterprise.

Importance: Segment reporting gives useful information about the performance of various segments that will help in better decision-making.

AS 18: Related Party Disclosures

Overview: AS 18 on related party disclosures prescribes the disclosures about related party relationships and transactions.

Importance: Proper disclosure of related party transactions ensures transparency and avoids conflict of interest.

AS 19: Leases

Overview: It defines accounting for leases, including classification and recognition.

Importance: Incorrect accounting for leases may not reflect the true obligations in the financial statements.

AS 20: Earnings Per Share

Overview: It prescribes the computation and presentation of earnings per share in financial statements.

Importance: Earnings per share (EPS) is a first-level important financial indicator for investors and other interested parties in assessing the profit-generating power of an enterprise.

AS 21: Consolidated Financial Statements

Overview: The standard deals with the accounting and disclosure requirements for preparing and presenting consolidated financial statements for enterprises under the control of a parent.

Importance: The consolidated financial statements present an overall perspective of the financial position and performance of the group of companies.

AS 22: Accounting for Taxes on Income

Overview: AS 22 deals with accounting for taxes on income, including the recognition of deferred tax assets and liabilities.

Importance: Proper accounting for income taxation ensures that the financial statements reflect the true tax obligations.

AS 23: Accounting for Investments in Associates

Overview: This standard provides guidelines on the kind of accounting treatment that investments of associates are subjected to in consolidated financial statements.

Importance: Proper accounting for the investments in associates ensures that the true and fair presentation of the investment situation of a group is appropriately presented in the financial statements.

AS 24: Discontinuing Operations

Overview: AS 24 governs the accounting and disclosure requirements for discontinuing operations.

Importance: Proper accounting for discontinuing operations will ensure that the impact of such operations on the financial position and performance is brought out in the financial statements.

AS 25: Interim Financial Reporting

Overview: This standard guides the preparation and presentation of interim financial reports.

Importance: Interim financial reporting will provide timely and relevant information to the users and hence enable them to make informed decisions.

AS 26: Intangible Assets

Overview: AS 26 lays down the accounting treatment for intangible assets and, in particular, deals with their recognition, measurement, and amortization.

Importance: If intangible assets are treated correctly, then it is likely to represent the financial statements faithfully—based on their value.

AS 27: Financial Reporting of Interests in Joint Ventures

Overview: This standard offers guidance on accounting for interests in joint ventures and reporting of joint venture operations.

Importance: Proper accounting for joint ventures ensures that financial statements portray a true and fair view of the financial position and performance of the joint ventures.

AS 28: Impairment of Assets

Overview: AS 28 lays down procedures to ensure that assets are carried at no more than their recoverable amount.

Importance: Proper impairment accounting ensures that the proper value of the assets will be presented in the books of account.

AS 29: Provisions, Contingent Liabilities, and Contingent Assets

Overview: The standard covers the accounting treatment for provisions, contingent liabilities, and contingent assets concerning their identification, measurement, and disclosure.

Importance: Proper accounting of provisions and contingencies is necessary for presenting a true and fair view of the financial position through financial statements.

Practical Applications and Case Studies

CA Inter students will be able to master these accounting standards for CA Inter only through practical applications and case studies. Understanding the dynamics and complexities of these standards can be achieved only by applying the theory in practical scenarios.

For example, creating a cash flow statement (AS 3) for different types of businesses or Valuation of inventories (AS 2) by different formulas leads to making the understanding and practice much stronger. In the same way, by the use of case studies, Revenue recognition (AS 9) can be made to understand how revenue is recognized differently in different industries.

Tips to CA Inter Students

- Proper Understanding: Understand each accounting standard in detail. What are the definitions, and criteria of recognition and measurement.

- Regular Practice: Practice problems and case studies of each standard should be a regular exercise. This would help in reinforcing the concept and improving problem-solving skills.

- Stay Updated: Accounting standards keep undergoing periodic revisions. Keep updating yourself with the latest amendments and interpretations.

- Use Mnemonics: Create mnemonics for key principles and concepts. This helps in quick recall of the same during exams.

- Group Studies: Discussing and studying in groups will, most often, help in gaining different perspectives and understanding complex topics better.

Delve into each standard, focusing on definitions and criteria for recognition and measurement. Regular practice through problems and case studies strengthens your grasp of concepts and hones problem-solving skills. Stay updated with periodic revisions and the latest amendments to the accounting standards for CA Inter. Use mnemonics for key principles, aiding quick recall during exams. Engage in group studies to gain diverse perspectives and better understand complex topics.

Conclusion

Accounting standards form the fulcrum of financial reporting and are significantly important in CA Inter preparation. A thorough knowledge of the standards not only builds confidence in performing well in examinations but also helps lay a solid footing for a successful professional life. A CA Inter student can be confident in facing his examinations and professional life if he understands accounting standards for CA Inter well, practices them regularly, and updates himself with the standards regularly.

Also Check:

- Trade Expenses in Trial BalanceUnderstanding financial terms is important for every business owner, student, or anyone interested in accounting. One such term is “Trade Expenses”, especially when it appears in the trial balance. This blog will explain what trade expenses are and what their… Read more: Trade Expenses in Trial Balance

- Legal Charges in Final AccountsWhen preparing final accounts for a business, one important topic that often confuses people is legal charges. These charges are not just legal fees or penalties. They have a specific meaning in accounting and finance. In this blog, we will… Read more: Legal Charges in Final Accounts

- Realisation Account FormatManagement of finances is always a must in any business, regardless of how large or small the business might be. Among the key tools in accounting is the Realisation Account. It is especially used in the process of winding up… Read more: Realisation Account Format

- Motive Power in Final AccountsMotive power in final accounts refers to the expenses related to the energy or power needed to run the machinery and equipment. Besides, the manufacturing or production-related industries are usually where these costs are found. Motive power expenses can include… Read more: Motive Power in Final Accounts

- Common Final Accounts Problems and How to Solve ThemAre you facing any final accounts problems? Then this blog is for you, here we will explain how you can solve those problems. By going through this article you can solve issues like incorrect trial balance, missing documentation, and many… Read more: Common Final Accounts Problems and How to Solve Them

Frequently Asked Questions

What are the main accounting standards for CA Inter students?

Some important Accounting Standards for CA Inter students include AS 1- Disclosure of Accounting Policies, AS 2- Valuation of Inventories, AS 3-Cash Flow Statements, AS 9-Revenue Recognition, AS 10-Property, Plant, and Equipment, and AS 11-The Effects of Changes in Foreign Exchange Rates.

Why is it important to understand accounting standards in CA Inter?

Accounting standards for CA Inter are essential because of the consistency, transparency, and accuracy of financial reporting. They are of critical importance, not only in the examinations themselves but also when entering professional practice.

How can I remember key accounting standards for CA Inter exams?

Some of the important accounting standards for the CA Inter exams can easily be remembered by using mnemonics, flashcards, frequent practices, and group discussions. Breaking down each standard into its core components also helps in remembering it properly.

What are the basic principles of accounting standards in CA Inter?

The four basic principles of accounting standards in CA Inter are consistency, relevance, reliability, and comparability. These principles ensure that a set of financial statements is so prepared as to truly reflect the financial position and performance of the company.

How do accounting standards impact financial statements?

These accounting standards impact the financial statements by providing a guideline on the manner of recognition, measurement, and disclosure of financial transactions. It offers a base under which financial statements could be uniform, comparable, and transparent for the stakeholders to make an informed decision.

Which accounting standards are most tested in CA Inter exams?

The most practiced accounting standards in CA Inter exams are AS 2, Valuation of Inventories; AS 3, Cash Flow Statements; AS 9, Revenue Recognition; and AS 10, Property, Plant, and Equipment. These standards are repetitively asked in the examination questions and case studies.

How do I apply accounting standards to practical problems?

Apply the accounting standards for CA Inter only after properly understanding each standard, with ample practice in case studies and solving past exam papers. This will ensure that with step-by-step approaches, all the aspects that answer the standard get covered.

What is the difference between IFRS and Indian Accounting Standards?

First and foremost, the most obvious difference is that IFRS are global standards while Indian Accounting Standards have been modified more or less explicitly to suit the legal and regulatory environment in India. Both, however, work for standardizing financial reporting.

How can I effectively study accounting standards for CA Inter?

Master the accounting standards for CA Inter by making a proper study time table and breaking each standard into parts that are easy to grasp, form mnemonics, practice problems regularly, keep revising, and join group studies.

Are there any changes in accounting standards for the current syllabus?

Changes in the Accounting Standards can be there to the current syllabus of CA Inter. Keeping updated with the latest amendments and interpretations issued from time to time by the regulatory bodies is necessary to ensure compliance with the most current standards.