A business has many expenses for running it. One of those is the trade expenses, indeed required for producing a product. These range from manufacturing to administrative expenses, like salaries, rent, etc. This blog will explain each and every detail of the trade expenses in final accounts.

What Are Trade Expenses?

Trade expenses are the recurring expenditures of running the day-to-day activities of a business concern, including labor expenses, advertisement expenses, conveyance expenses, etc. Let us see how trade expenses are different from other business expenses.

Trade expenses are involved in the running of every business. These represent the expenses incurred in rendering a product or service ready for marketing and then selling the product or service. They are broadly classified into two kinds: direct and indirect trade expenses.

Direct Trade Expenses

Direct trade expenses are those costs that are directly accountable to manufacture goods or services. These include:

- Labor Costs: Wages paid to employees who are engaged directly with the manufacturing or production process.

- Raw Materials: The cost of materials that go directly into the production of goods

- Manufacturing Supplies: Costs of supplies and consumables used in the production process.

Indirect Trade Expenses

Indirect trade expenses are said to be those that are not directly connected to the line of production but are nonetheless involved in the running of the business. These include:

- Salaries: Remunerations paid to the administrative and support staff.

- Utility Bills: Consumptions of electricity, water, and other utilities used in running the business.

- Rent: Expenses incurred on renting business premises.

- Advertising and Marketing: These are expenses incurred in popularizing the products or services.

- Transportation: This involves costs connected with shipment and logistics.

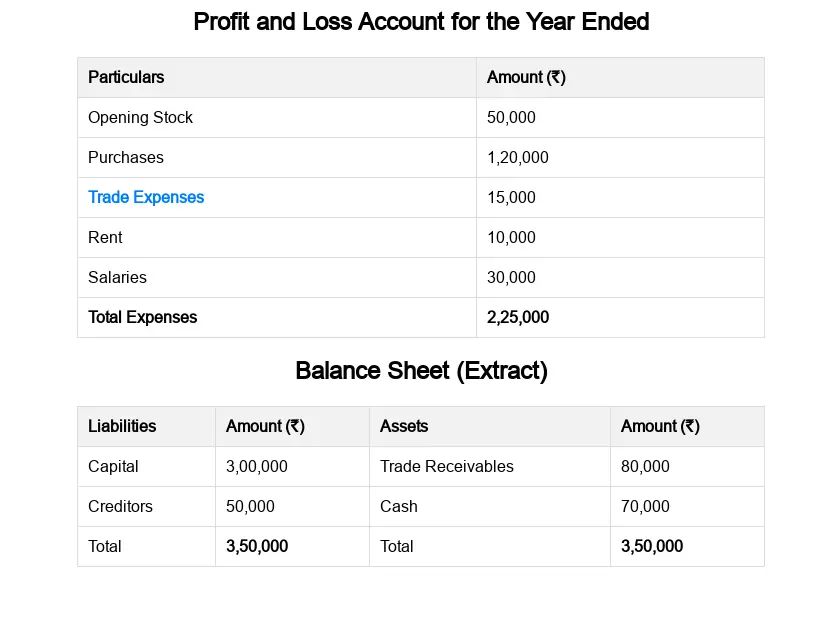

Final Accounts Example – Trade Expenses

How Trade Expenses Differ from Other Business Expenses

Trade expenses are related to costs incurred by operational activities connected with the production and sales of goods or the rendering of services. Other business expenses, on the other hand, may mean costs incurred in the general functioning of a business. Such expenses would include, in contrast to trade expenses that are directed at the very core activities of production and sales, general administrative expenses, and financial costs, among others.

Accounting for Trade Expenses

It is essential that proper recording of trade expenses is done for the financial health of any business. This is how, in most of the cases, these expenses are recorded in accounting books:

Journal Account

These trade expenses are recorded in a Journal Account, which the business keeps. All entries concerning such expenses are noted down on the debit side of the account. The Journal Account is the central book of entry where every financial transaction is first recorded. Each account in the Journal Account gives the date, description of the account, and amount.

Ledger Accounts

These are posted from the Journal Account to respective Ledger Accounts. Ledger Accounts are accounts that give the details of all transactions related to specific categories of trade expenses. Examples could be the existence of separate ledger accounts for labour, raw materials, salaries, utility bills, rent, advertisement, transportation, and so on.

Also Read: Essential Accounting Standards for CA Inter Preparation

Role of Invoices, Receipts, & Other Documentation

Proper documentation is important in capturing and validating business expenses. Some of the crucial documents are:

Invoices

Invoices are obtained at the time of purchase of goods or availing services. They contain the following information about a transaction: date, description of goods or services, quantity, rate, and total amount. Invoices are very critical since they reflect correct data for accounting and tax filing purposes.

Receipts

They are issued upon the payment for an item or service rendered. They are the most important receipts in reconciliations and also prove the payment to a vendor from whom one wants to return a product, claim tax deductions, or seek reimbursement.

Other Documents

There exist other forms of documents, such as purchase orders, delivery notes, and contracts, which help confirm a trade expense incurred and post it in the books. These documents detail and support the entries made in an accounting system.

Impact of Trade Expenses on Final Accounts

Trade expenses have a significant impact on the final accounts of a business. This is how they affect the main financial statements:

Impact on Profit and Loss Account

One of the three primary financial statements is a Profit and Loss Account, while the other two are a Balance Sheet and a Cash Flow Statement. The P&L Account indicates the revenues that a business gathers, the costs incurred during a certain period, and the respective expenses that are finally realized, leading to the computation of its net profit or loss.

Trading Account: The trading account represents a part of the P&L Account. It contains information about the gross profit earned by the organisation. Gross profit would be the result of deducting COGS from the Net Sale item. The cost of goods sold will include direct trade expenses like raw materials and labor costs.

Statement of Profit and Loss: Net profit is arrived at by transferring gross profit to the profit and loss account and deducting, firstly, all indirect trade expenses, and secondly, other business expenses. Thus, net profit will be gross profit minus indirect trade expenses like salaries, utility bills, rent, advertisement, transportation, etc.

Impact on Balance Sheet

The Balance Sheet presents a snapshot of the financial position of the business at any point in time. It holds information regarding the business’s assets, liabilities, and equity. Trade expenses influence the Balance Sheet in the following manner:

- Current Assets: Raw materials and supplies are examples of trade expenses that get recorded as current assets until they get used in the process of production.

- Current Liabilities: Outstanding trade expenses for salaries and utility bills are considered current liabilities.

- Equity: The net profit or loss from the P&L Account is transferred to the equity section of the Balance Sheet, which accounts for the impact of the trade expenses in retained earnings of the business.

Role of Trade Expenses in Financial Planning

Budgeting and forecasting of the future trade expenses are done to perform effective financial planning. Past trade expenses can help in estimating the future costs of the business, which in turn will help to set up resources. The setting of realistic financial goals will allow funds to be made available for funding the operational activities of the business.

Importance of Trade Expenses for Decision Making

Proper recording and analysis of trade expenses provide important information useful in various decisions taken by the owners and managers of the business.

Decrease/Control Costs: Indicate areas in which costs may be reduced or optimized.

Set Pricing: Apply appropriate pricing strategies, considering the cost of production.

Resource Allocation: Optimize resource allocation to various departments or projects.

Plan Investments: Decide on investments in new machinery, technology, or expansion plans.

Conclusion

We have taken a glimpse through this blog into how trade expenses finally get reflected in an organization’s books of account. Direct and indirect trade expenses are incurred while running a business. Proper recording and analysis of these costs are, therefore, very important for financial management, compliance, and strategic decision-making. With the knowledge of the trade expenses and their effects on the financial statement, businesses are better able to manage their finances to optimize profitability and ensure long-term success. Information, as shown above on trade expenses, is highly recommended to be clearly gone through to get a clear understanding of their role in financial accounting.

Also Check:

- Trade Expenses in Trial BalanceUnderstanding financial terms is important for every business owner, student, or anyone interested in accounting. One such term is “Trade Expenses”, especially when it appears in the trial balance. This blog will explain what trade expenses are and what their… Read more: Trade Expenses in Trial Balance

- Legal Charges in Final AccountsWhen preparing final accounts for a business, one important topic that often confuses people is legal charges. These charges are not just legal fees or penalties. They have a specific meaning in accounting and finance. In this blog, we will… Read more: Legal Charges in Final Accounts

- Realisation Account FormatManagement of finances is always a must in any business, regardless of how large or small the business might be. Among the key tools in accounting is the Realisation Account. It is especially used in the process of winding up… Read more: Realisation Account Format

- Motive Power in Final AccountsMotive power in final accounts refers to the expenses related to the energy or power needed to run the machinery and equipment. Besides, the manufacturing or production-related industries are usually where these costs are found. Motive power expenses can include… Read more: Motive Power in Final Accounts

- Common Final Accounts Problems and How to Solve ThemAre you facing any final accounts problems? Then this blog is for you, here we will explain how you can solve those problems. By going through this article you can solve issues like incorrect trial balance, missing documentation, and many… Read more: Common Final Accounts Problems and How to Solve Them

Frequently Asked Questions

What are trade expenses in final accounts?

Trade expenses are the costs that a business has to incur for the manufacture and sale of products. This may include raw materials, labour expenses, and marketing expenses. They are accounted for in final accounts in order to highlight the amount spent by the business to achieve sales.

How do trade expenses affect final accounts?

This reduces the profit of the business because the trade expenses are subtracted from the revenues in order to arrive at the net profit. If the trade expenses are too high, they can reduce the profits, and good management can improve the financial outcome of the business.

Why are trade expenses important in accounting?

Accounting treats trade expenses as a very significant aspect because they aid in defining the real cost of business operations. They help one view where the money is going; hence, they are beneficial in better decision-making on cost control and increasing profits.

What items are included in trade expenses?

These will include raw materials, labor, utilities, rent, transportation, and marketing. All these expenses incurred in producing and selling products are necessary and, therefore, have to be recorded to understand the total cost of the business.

How do you record trade expenses in accounts?

The trade expense is recorded in the accounting system with the help of a Journal Account. Under the column Debit, entries of all the expenses are made, stating how much has been spent. In this way, all the money spent on business gets accounted for.

What is the difference between trade and non-trade expenses?

Trade expenses are relevant to the manufacturing and selling of merchandise, such as raw materials and direct labor expenses. Non-trading expenses include that expenditure which is not directly related to production—for instance, stationery and salaries to office staff. Both types are recorded but have different purposes in accounting.

How do trade expenses impact net profit?

Such expenses reduce the net profit since they are subtracted from the total revenues. High trade expenses bring down net profit, while their reduction increases it. Managing such expenses well helps improve the profitability of the business.

Can trade expenses be deducted for tax purposes?

Yes, trade expenses can usually be deducted against tax. The business can subtract these costs from its taxable income to reduce the amount of tax it needs to pay. It is essential to record them accurately for claiming deductions.

How to manage and control trade expenses?

The management of trade expenses involves proper bookkeeping of all costs, checking wastages, negotiating better prices with the suppliers, and reviewing spending periodically. Accounting software may also be adapted to maintain organized and controlled expenses.

What are common mistakes in recording trade expenses?

Some of the common mistakes that are made while recording trade expenses are missing to record small expenses, mixing up personal and business costs, not keeping the receipts, and misclassifying the expenses. Types of errors that need to be avoided are those that may affect the accuracy of financial records and eventually the financial health of the business.