A proforma invoice is like a draft bill sent to buyers before goods are shipped or delivered. It is not a request for payment but a document that outlines the terms of the sale. It includes details like the price, quantity, and description of the goods. Essentially, it provides an estimate and confirms the details of the transaction before it is finalized.

Importance of Proforma Invoices

Proforma invoices are important for several reasons:

- Clarity on Terms: They clarify the terms of sale, helping both the buyer and seller agree on details to avoid misunderstandings.

- Customs Use: In international trade, customs use these invoices to calculate import duties and taxes. They are also needed for obtaining import licenses.

- Financial Planning: Buyers can use them for budgeting and understanding the total cost, including shipping and taxes.

- Advance Payments: While not a payment demand, they can be used to request advance payments, especially for international deals.

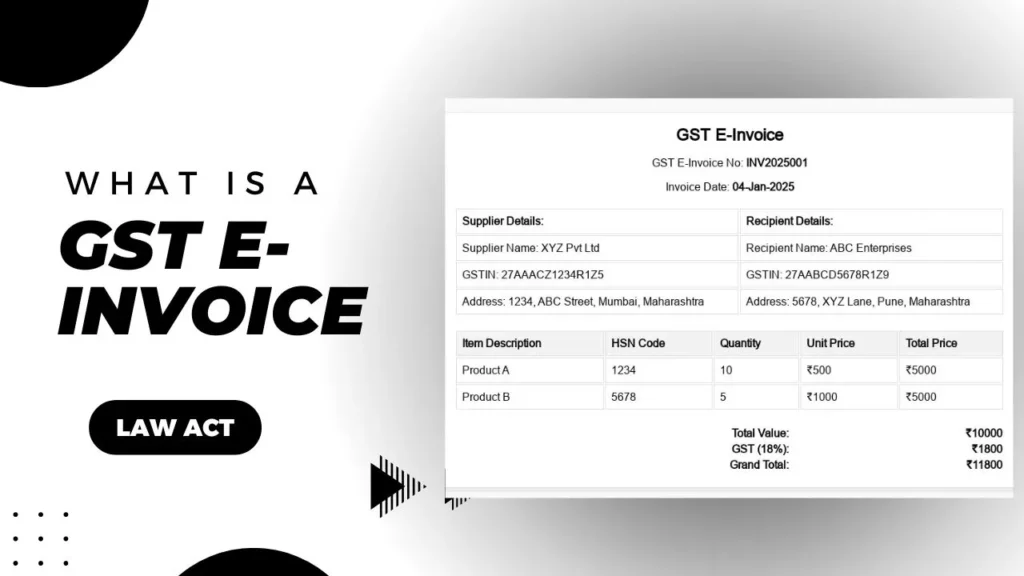

Read Also: What is a GST E-Invoice and How Does It Work?

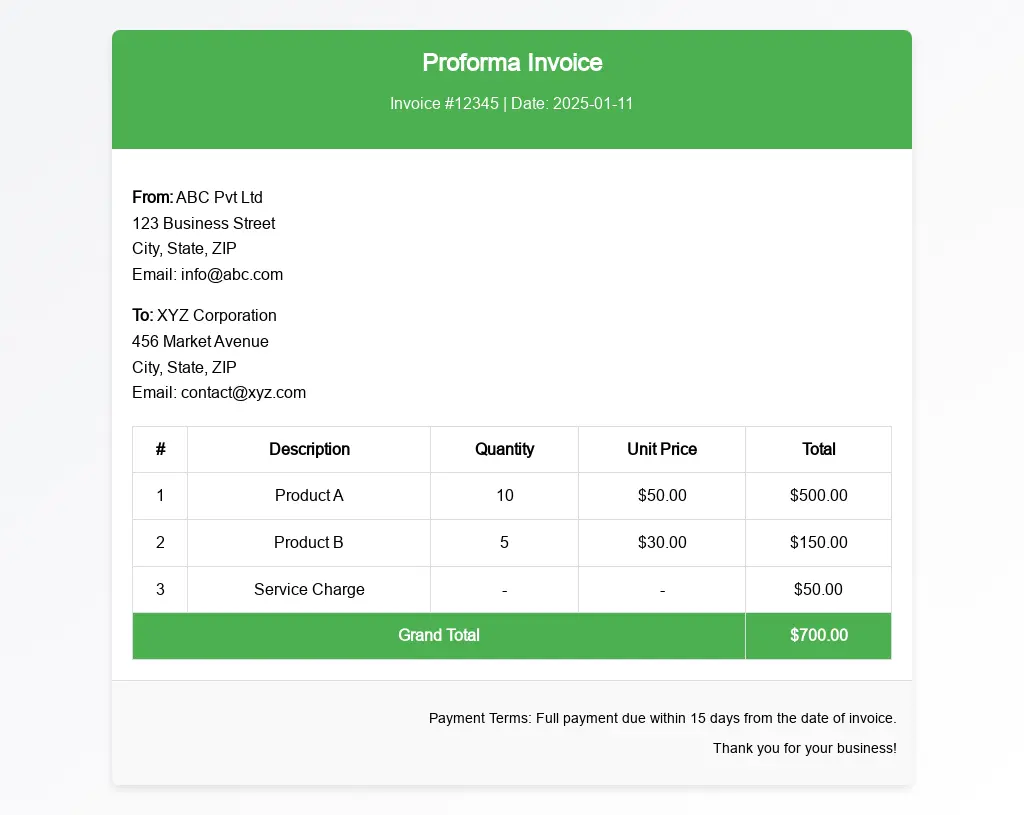

Proforma Invoice Example Format

Key Components of a Proforma Invoice

To prepare a proforma invoice, include the following:

- Seller’s Information: The seller’s name, address, contact details, and GSTIN.

- Buyer’s Information: The buyer’s name, address, and contact details.

- Invoice Number and Date: A unique invoice number and the date it is issued.

- Description of Goods or Services: Details about the products or services, including quantities and specifications.

- Price: Unit price and the total amount.

- Terms and Conditions: Payment terms, delivery schedule, and return policies.

- Taxes and Duties: Information about applicable taxes and duties.

- Shipping Information: Details of the shipping method, delivery address, and estimated delivery date.

- Signatures: Signed by authorized representatives of both the buyer and seller.

Legal Implications of Proforma Invoices in India

In India, proforma invoices are not legally binding and cannot be used for tax or accounting purposes. However, they play a vital role in ensuring clarity and agreement before finalizing a transaction. Under the GST system, proforma invoices help create accurate commercial invoices and ensure compliance with GST regulations.

Difference Between Proforma Invoice and Invoices.

| Aspect | Proforma Invoice | Commercial Invoice |

|---|---|---|

| Timing | Issued before the sale. | Issued after the sale is confirmed and goods are ready to deliver. |

| Purpose | Serves as a draft or estimate. | Formal payment request. |

| Use | Used to confirm transaction details before finalizing. | Acts as a final record of the transaction. |

| Legal Status | Not legally binding or valid for tax purposes. | Legally binding and valid for tax/accounting purposes. |

| Customs | Helps with import/export procedures and customs. | Used by customs for clearing goods and calculating duties. |

Uses of Proforma Invoices in India

- Domestic Transactions: They are used as quotes to negotiate terms and confirm details before issuing the final invoice.

- International Trade: Exporters use them to give buyers detailed information about goods, pricing, and terms. They are often required for import licenses or financing.

- Customs Clearance: Customs may need them to determine the value of goods for import duties.

- Financial Planning: Businesses use them to forecast revenue and prepare for future transactions.

- Advance Payments: They can request upfront payments, reducing risk in international trade.

Here’s a Proforma Invoice Sample To Get a Better Understanding:-

Let us suppose, an Indian exporter is selling handmade textiles to a buyer in Europe. The exporter will issue a proforma invoice to the buyer, detailing the quantity, description, and price of the textiles, along with the terms of sale. The buyer will then review the proforma invoice and agree to the terms. The buyer then uses the proforma invoice to obtain an import license and secure financing from their bank. Once everything is in place, the exporter will ship the textiles and issue a commercial invoice for the final payment.

Conclusion

Proforma invoices are indispensable in domestic and international trade. They help businesses define terms, plan finances, and ensure compliance with regulations. Although they are not legally binding, their role in streamlining transactions is vital. Businesses should create detailed and accurate proforma invoices to enhance operations and build trust with buyers and suppliers.

Also Read:

- Understanding Tax InvoicesTax invoices are critical documents in the field of commerce and taxation. They serve as proof of transaction and facilitate tax compliance for both sellers and buyers. In India, the introduction of the Goods and Services Tax (GST) in July… Read more: Understanding Tax Invoices

- Purchase Orders (PO) and Purchase Invoices (PI)Purchase orders (PO) and purchase invoices (PI) are two of the most significant documents in doing business, but the two bear more or less similarities that cause confusion between them. It is highly important to know how these two differ… Read more: Purchase Orders (PO) and Purchase Invoices (PI)

- How to cancel an e-invoice?E-invoicing is a major reform that came along with India’s Goods and Services Tax (GST) framework. It mandates that businesses generate their invoices through the GST portal or a registered invoice registration portal (IRP), ensuring standardization and seamless integration with… Read more: How to cancel an e-invoice?

- What is a Proforma Invoice?A proforma invoice is like a draft bill sent to buyers before goods are shipped or delivered. It is not a request for payment but a document that outlines the terms of the sale. It includes details like the price,… Read more: What is a Proforma Invoice?

- What is a GST E-Invoice and How Does It Work?Since the time the e-invoicing concept got approval from the GST Council, it has become quite popular in the business community. The e-invoicing concept was sanctioned during the 37th meeting of the GST council back in September 2019, and since… Read more: What is a GST E-Invoice and How Does It Work?

Frequently Asked Questions

What is a proforma invoice?

A proforma invoice is like a draft bill sent to a buyer before shipping goods. It shows details like price, quantity, and description of the items. However, it is not a payment request.

Why is a proforma invoice used?

It is used to give buyers a detailed estimate of the sale. This helps buyers understand the costs and terms before agreeing to buy. It is useful for getting financing, import licenses, arranging shipping, and ensuring both the buyer and seller agree on the details.

Who prepares a proforma invoice?

Usually, the seller or exporter prepares the proforma invoice. It helps the buyer or importer know about the goods or services, their prices, and the terms before completing the sale.

When do you need a proforma invoice?

You need a proforma invoice in situations like:

Giving a quote to a buyer.

Helping the buyer secure financing or credit.

Assisting with import/export processes, like getting licenses or clearing customs.

Confirming the transaction details before finalizing.

Helping the buyer arrange prepayment or shipping.

What details are included in a proforma invoice?

A proforma invoice includes:

Seller’s and buyer’s contact details.

Description of goods or services.

Quantity, unit price, and total price.

Terms of sale and payment.

Delivery terms and shipping details.

The invoice date and number.

The validity period of the invoice.

Any taxes, duties, or extra charges.

What is the difference between a proforma invoice and a regular invoice?

A proforma invoice is sent before delivery as an estimate and is not legally binding. It is used for planning and confirmation. A regular invoice is sent after delivery to request payment and is legally binding for tax and accounting purposes.

How do you create a proforma invoice?

To create a proforma invoice:

Clearly label it as a “Proforma Invoice.”

Add the seller’s and buyer’s information.

Include the invoice number and date.

List the items with descriptions, quantities, and prices.

Show the total amount.

Make sure it states that it is for estimation purposes, not for payment.

Can a proforma invoice be used for payment?

No, you cannot use a proforma invoice for payment. It is just an estimate and not legally valid for requesting payment. Only a regular invoice can be used to ask for payment after the goods or services have been delivered.

Where can I find a sample of a proforma invoice?

You can find sample proforma invoices on websites like Lawact.in, Microsoft Office, Google Docs, or Template.net. These templates are ready-made and can be customized to fit your business needs.

How does a proforma invoice help in business transactions?

A proforma invoice helps by giving a clear estimate of costs and terms to the buyer before making a final decision. It helps plan finances, arrange shipping, manage import/export processes, and ensures both sides agree on the details before completing the transaction.