Since the time the e-invoicing concept got approval from the GST Council, it has become quite popular in the business community. The e-invoicing concept was sanctioned during the 37th meeting of the GST council back in September 2019, and since then it has become an important part of the GST ecosystem.

By transitioning to a GST e-invoice, businesses can quickly reduce the risk of tax evasion because of the improved traceability and transparency of transitions. Apart from that, e-invoices also facilitate accurate recording and processing of data, thereby reducing errors, enhancing the reliability and integrity of financial records, and promoting compliance with GST rules.

Taking the above note forward, today in this blog, we will learn about e-invoice, how it works, and its significance. So, let’s get started!

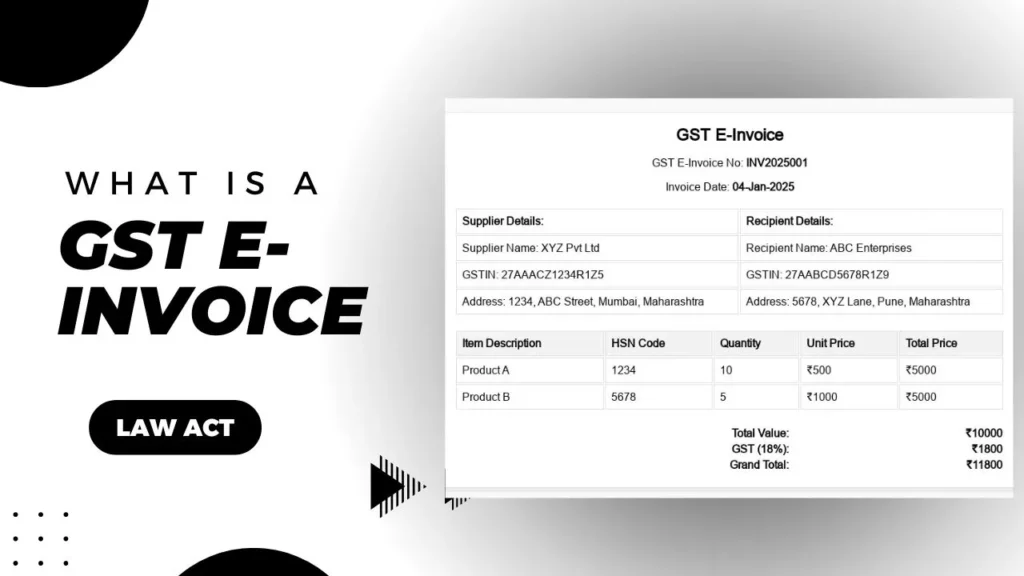

What is a GST e-invoice?

An electronic invoice, or e-invoice, is a digital document validated by the government tax portal that is exchanged between a supplier and buyer. It is a proposed system where B2B (business-to-business) invoices are digitally prepared in an e-invoicing format and verified by the Goods and Services Tax Network (GSTN). Simply put, this system ensures that a common format is followed by all businesses before it is reported to the GST portal.

Who is required to generate an e-invoice and its applicability?

GST e-invoice applicability can be explained in the following manner:

a) Turnover criteria or e-invoice limit

| Phase | Applicable to taxpayers with a gross turnover of more than | Applicable Date |

| 1 | Rs 500 crore | 01.10.2020 |

| 2 | Rs 100 crore | 01.01.2021 |

| 3 | Rs 50 crore | 01.04.2021 |

| 4 | Rs 20 crore | 01.04.2022 |

| 5 | Rs 10 crore | 01.10.2022 |

| 6 | Rs 5 crore | 01.08.2023 |

Note: The taxpayers need to follow with e-invoicing in FY 2022-23 and onwards if their e-invoice GST limit or turnover exceeds the mentioned limit in any financial year from 2017-18 to 2021-22. Also, the gross turnover will include the turnover of all GSTINs under a single PAN across India.

If the turnover in the last financial year was below the specified limit but increased beyond the limit in the current year, then e-invoicing would become applicable from the beginning of the next financial year.

b) Transaction and document criteria

The listed documents and transactions fall under GST e-invoice applicability:

| Documents | Transactions |

| Credit notes, tax invoices, and debit notes under Section 34 of the CGST Act | Exports, taxable B2B sales of goods and services, business to government sales of goods and services, supplies to SEZs, deemed exports, stock transfers or supply of services to distinct persons, SEZ developers and supplies under reverse charge are covered under Section 9(3) of the CGST Act. |

Who is not required to comply with e-invoicing?

In India, certain entities are exempt from following the e-invoicing requirements under the Goods and Services Tax (GST) system. As of the latest updates, the following entities are generally not required to comply with e-invoicing:

1) Insurers and banking companies:

Companies in the insurance and banking sectors, including non-banking financial companies (NBFCs).

2) Goods Transport Agencies (GTAs):

Entities providing goods transportation services.

3) Passenger transportation services:

Entities involved in the transport of passengers.

4) SEZ units:

Units located in Special Economic Zones (SEZs), though this does not extend to SEZ developers.

5) Government departments and local authorities:

Government bodies and local municipal authorities.

6) Entities with turnover below a specified threshold:

Businesses with an aggregate turnover in any preceding financial year below the specified threshold .

It is always recommended to refer to the latest notifications from the GST Council or consult with a tax professional to get the most current and detailed information regarding e-invoicing compliance.

What is the workflow of an e-invoice?

The workflow of a GST e-invoice includes various steps, from generating the invoice to validation and approval on the government portal. Here’s detailed information on the e-invoicing workflow.

1) Invoice generation

- The supplier is required to generate an invoice using their ERP or accounting system.

- However, the invoice prepared must adhere to the JSON specified format as prescribed by the e-invoice schema.

2) Generation of IRN

- After that, the supplier’s system uploads the JSON file to IRP (Invoice Registration Portal).

- Then, the IRP validates the invoice details and generates a unique invoice Reference Number (IRN).

3) IRP validation

- Now, the IRP performs multiple verifications to ensure that the invoice data is correct.

- After verification, the IRP generates a digitally signed GST e-invoice.

4) e-invoice download

- The supplier can download the digitally signed e-invoice with the IRN.

- Suppliers can get their e-invoice printed or send it electronically to the buyer.

5) Transmission to the GST system

- The invoice registration portal later transmits the verified e-invoice to the GST system (GSTN) and the e-way bill system.

6) Invoice sharing

- Suppliers can share the generated invoice with the buyer.

- Later, the buyer can confirm the authenticity of the invoice by checking the details on the GST portal.

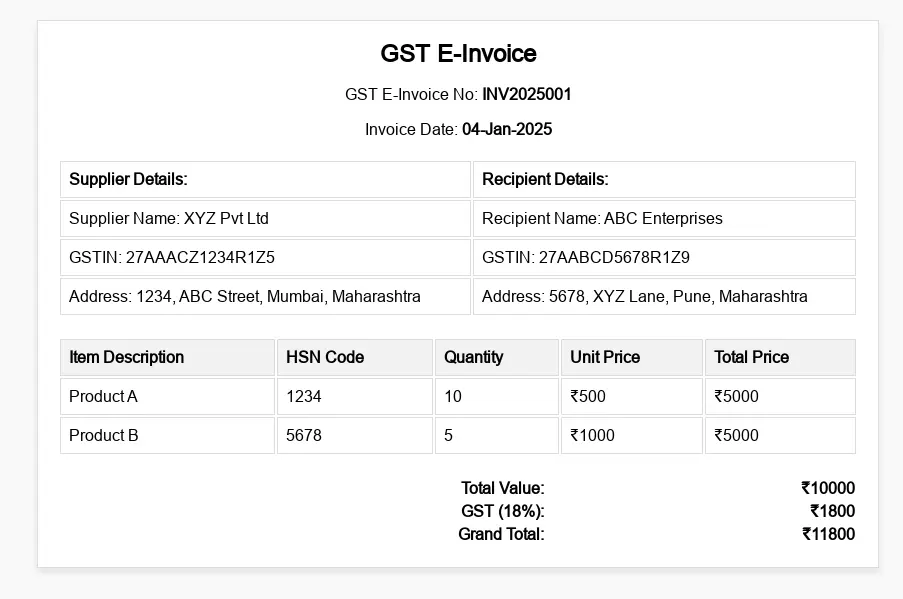

GST E-Invoice Format

Go for free invoice formats:

- GST Invoice Format With Discount – Download for Free

- GST Invoice Format in Excel, Word, Pdf

- GST Invoice Format With Service Charges – Download for Free

How to generate an e-invoice in GST portal?

To generate GST e-invoice, the following steps can be followed:

- Visit the e-invoice portal and click on the ‘Registration’ button.

- Now, select e-invoice enablement and enter your company’s GSTIN.

- After that, complete the OTP verification and provide annual turnover details of the relevant year.

- Submit the information to register for e-invoicing.

- Then, log-in to the GST e-invoice portal and upload invoices using preferred mode to generate Invoice Reference Number (IRN).

How to verify E-Invoice

What are the benefits of a GST e-invoice?

- Reduced errors: With e-invoice, the chances of errors in e-invoicing reduces, which results in greater accuracy and fewer disputes.

- Saves costs: e-invoice helps in reducing the costs of printing, paper, and postage, saving businesses money in logistics and bulk printing.

- Quick payment processing: GST e-invoice is efficient and faster, allowing businesses to receive payment faster, improve cash flow, and reduce late payments.

- Minimizes compliance risks: e-invoice system ensures that businesses are complying with GST regulations by automatically updating invoices with taxes, and offering real-time validation of invoice details.

Saves time: e-invoice eliminates manual processing, automates various processes, making it easier for the businesses to manage their finances.

Also Read:

- Latest GST 2.0 Rules in 2025The year 2025 has brought one of the biggest reforms in India’s tax system since GST (Goods and Services Tax) was first introduced in 2017. The government has simplified GST slabs, reduced rates on essential goods, increased taxes on luxury… Read more: Latest GST 2.0 Rules in 2025

- All Types of Full Form in GSTGST can be confusing, especially with so many short forms and codes used in the system. Whether you’re a business owner, accountant, or just someone trying to file your GST returns, knowing the full forms and meanings of these terms… Read more: All Types of Full Form in GST

- About GST and Its Impact on the Indian EconomyIntroduction to GST The Goods and Services Tax (GST) is one of the major tax reforms in India since its independence. Implemented on July 1, 2017, GST replaced a plethora of indirect taxes that were previously levied by both central… Read more: About GST and Its Impact on the Indian Economy

- How to check GST number: Step-by-StepIndia’s taxation system has undergone a lot of changes since the introduction of GST. For those unaware, GST (Goods and Services Tax) is an indirect tax that is imposed on the supply of goods and services. To put it in… Read more: How to check GST number: Step-by-Step

- Understanding Tax InvoicesTax invoices are critical documents in the field of commerce and taxation. They serve as proof of transaction and facilitate tax compliance for both sellers and buyers. In India, the introduction of the Goods and Services Tax (GST) in July… Read more: Understanding Tax Invoices

Frequently Asked Questions

What is a GST e-invoice and why is it important?

A GST e-invoice is a standard electronic format for invoicing under India’s GST system, ensuring quick sharing and real-time validation. It is important because it enhances transparency, reduces tax evasion, and simplifies compliance for businesses.

How do I access the GST e-invoice portal?

To access the GST e-invoice portal, visit the official website at https://einvoice1.gst.gov.in and log in using your GSTIN and credentials. If you are a first-time user, you need to register your business on the portal.

What are the steps to generate an e-invoice in the GST portal?

To generate an GST e-invoice in the GST portal, start by logging in using your GSTIN and credentials. Once logged in, you need to enter the invoice details or upload the JSON file of the invoice. After the details are entered, submit the invoice data to the portal, which will generate an Invoice Reference Number (IRN) and a QR code. Finally, download the validated e-invoice that includes the IRN and QR code for your records and further use.

Who needs to use the GST e-invoice system?

Businesses with gross turnover exceeding the specified threshold (currently ₹50 crore) need to use the GST e-invoice system for generating invoices.

What is the turnover limit for GST e-invoice applicability?

The turnover limit for GST e-invoice applicability is ₹50 crore.

How does the GST e-invoice portal work?

The GST e-invoice portal functions by allowing businesses to upload invoice details or JSON files, which are then validated and assigned an Invoice Reference Number (IRN) and QR code.

Are there any special requirements to generate an e-invoice in the GST portal?

Yes, to generate an e-invoice in the GST portal, businesses need to ensure compliance with specified invoice schema and standards, upload invoice details or JSON files accurately, and obtain an Invoice Reference Number (IRN) along with a QR code from the portal.

What are the benefits of using the GST e-invoice system?

The GST e-invoice system offers benefits such as improved transparency in transactions and streamlined compliance with GST regulations, enhancing efficiency and reducing tax evasion.

How can I check if my business qualifies for the GST e-invoice limit?

To check if your business qualifies for the GST e-invoice limit, verify your aggregate turnover for the financial year. If it exceeds ₹50 crore, your business is required to comply with the GST e-invoice system.

What should I do if I face issues with the GST e-invoice portal?

If you face issues with the GST e-invoice portal, you can reach out to the GST helpdesk for assistance. They can provide support and guidance regarding technical or operational challenges you encounter while using the portal.