Since the introduction of GST, it has become essential for all eligible individuals and business entities that supply goods and services to register for GST. Not just registration, it has now become essential to understand the main components of the new GST system, which include the taxation slab, registration process, documentation required, a way to check the status of the registration, and more. So, if you are new to getting a GST number and have no clear idea about the procedure, then here in this guide, you will find all the relevant details that will help you understand the complete process of how to get a GST number.

What is GSTIN, or GST Number?

GSTIN, or GST Number, is a 15-digit identification number assigned to every taxpayer registered under GST that assists with tax collection procedures, input credit claims, and GST return filings.

As per GST, when a business’s revenue is either Rs. 40 lakh, Rs. 20 lakh, or Rs. 10 lakh, the owner of the business needs to register under GST as a regular taxable person. Most people don’t know there are several types of GST registration under the GST Act, which include: process is known as GST registration. However, most people don’t know there are several types of GST registration under the GST Act, which include:

- Normal taxpayer: A majority of enterprises in India fit under this group. To become an ordinary taxpayer, you don’t have to make any deposits.

- Casual taxable person: This category is for people who wish to open a temporary store or booth. However, in this particular category, you have to pay a deposit in advance equal to the GST liability. Further, the validity of the GST registration under this category is three months, which can be renewed or extended.

- Composition taxpayer: To become eligible for this category, you need to submit an application for the GST composition scheme. This particular category demands a one-time flat deposit. Also, the input tax credit is not applicable to this category.

- Non-resident taxable person: If you are based out of India and yet want to sell goods to residents, then you need to select this type of registration. Similar to the casual taxable person type, you are required to pay a deposit, which is equivalent to the estimated GST liability.

Who must get a GST number?

Listed below are the individuals and companies that need to finish GST registration and learn about how to get a GST number:

- Persons registered with tax services before GST was implemented.

- Taxable individuals who are not residents or casual taxpayers.

- Every online retailer aggregator.

- People pay taxes through the reverse charge method.

- Companies whose annual revenue exceeds Rs. 40 lakhs. And for Himachal Pradesh, Uttarakhand, Jammu and Kashmir, and the Northeast, the turnover of the business exceeds Rs. 10 lakhs.

- People who supply online data and database access to India residents who are not registered taxable individuals from abroad.

- Distributors and agents of input service providers.

- For enterprises that have annual revenue exceeding Rs. 20 lakhs.

Also Read:

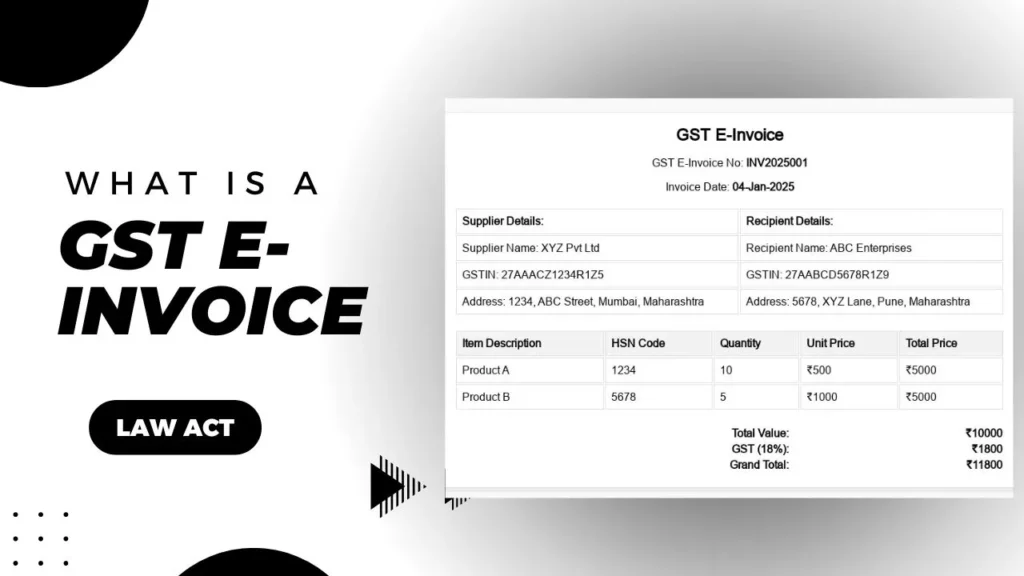

- What is a GST E-Invoice and How Does It Work?

- About GST and Its Impact on the Indian Economy

- How to check GST number: Step-by-Step

How to get the GST number?

Here are the detailed steps that you can follow:

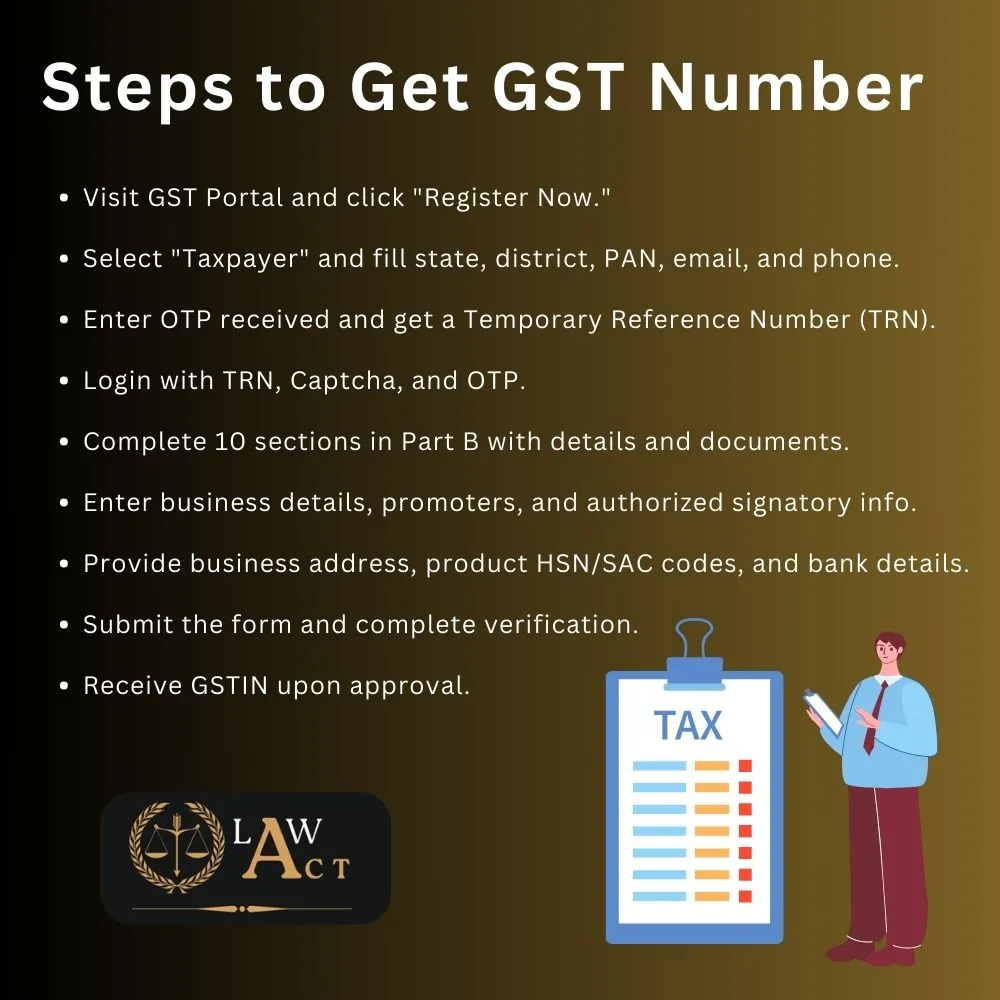

Steps for how to get GST number

Step 1: Visit the official GST portal at https://www.gst.gov.in.

Step 2: Click on the Services option and select the Register Now link.

Step 3: Enter the following details:

- Click on the fresh registration button.

- Choose taxpayer from the drop-down menu under’ I am a’

- Now, choose state and district from the drop-down menu.

- Enter your business name and PAN here.

- Enter your mobile number and email address.

- An OTP will be delivered to your registered number and email.

- Now, click on ‘Proceed’.

Step 4: Enter the OTPs that you received via email or mobile device and click on ‘Continue’.

Step 5: A 15-digit temporary reference number (TRN) will be issued. Remember, after the issuance of the TRN, you only have 15 days to complete Part B of the registration.

Step 6: Visit the GST portal and select ‘New Registration’.

Step 7: Now, choose Temporary Reference Number and proceed by entering Captcha and TRN.

Step 8: Once done, an OTP will be sent to your registered phone number and email. Enter the OTP and proceed.

Step 9: There are ten parts in Part B of the registration. Fill out all the fields and include all the required files.

Step 10: Enter the trade name, business constitution, and district under the ‘Business Details’ box.

- Select ‘Option for Composition’ by checking the box whether you wish to use the composition system or not.

- Also, select registered person categories such as service providers, manufacturers, or any individual qualified under the composition scheme.

- Enter the district and location details based on the choice made.

Step 11: Enter the details for up to ten promoters or partners under the promoters/partners page, along with their required details.

Step 12: As per step 8, input Authorized Signatory’s details.

Step 13: Enter the details of Principal Place of Business information.

Step 14: Enter product and service info in the next tab, including the details of SAC or HSN codes.

Step 15: Now, enter the taxpayer bank info.

Step 16: Provide a professional tax employee code, PT registration certificate number, and state excise license number, along with the holder’s name. Then, select Save and Continue.

Step 17: After that, decide whether you wish to complete the Aadhar authentication process or not.

Step 18: Proceed to the verification page after filling out all the information.

Step 19: If the application gets accepted, a notice will be shown along with the application reference number and will be emailed or sent on the registered email or phone number.

Further, if you have queries regarding how many days to get a GST number, it is suggested that you can expect to receive the GSTIN or GST number and registration certificate within 3–7 working days after application submission, provided all the documents and details are in order and there are no issues with the application.

And in case you haven’t received your GSTIN within the mentioned time frame, you can check the status of your application on the GST portal or reach out to the help desk for assistance.

Also Check:

- Latest GST 2.0 Rules in 2025The year 2025 has brought one of the biggest reforms in India’s tax system since GST (Goods and Services Tax) was first introduced in 2017. The government has simplified GST slabs, reduced rates on essential goods, increased taxes on luxury… Read more: Latest GST 2.0 Rules in 2025

- All Types of Full Form in GSTGST can be confusing, especially with so many short forms and codes used in the system. Whether you’re a business owner, accountant, or just someone trying to file your GST returns, knowing the full forms and meanings of these terms… Read more: All Types of Full Form in GST

- About GST and Its Impact on the Indian EconomyIntroduction to GST The Goods and Services Tax (GST) is one of the major tax reforms in India since its independence. Implemented on July 1, 2017, GST replaced a plethora of indirect taxes that were previously levied by both central… Read more: About GST and Its Impact on the Indian Economy

- How to check GST number: Step-by-StepIndia’s taxation system has undergone a lot of changes since the introduction of GST. For those unaware, GST (Goods and Services Tax) is an indirect tax that is imposed on the supply of goods and services. To put it in… Read more: How to check GST number: Step-by-Step

- How Does GST Return Penalty WorkThrough this article, we will explain the penalty system associated with GST return filing. By understanding these penalties you can ensure compliance with GST regulations and avoid financial repercussions. We will cover various types of penalties, including late fees, interest on… Read more: How Does GST Return Penalty Work

Frequently Asked Questions

What are the steps to get a GST number?

To get a GST number, you will require to register online on the GST portal, submit required documents, and await approval from the tax authorities.

How long does it take to get a GST number?

The GST number is typically allotted within 3-7 working days after submission of all required documents and completion of registration process. However, if you still have queries on how many days to get a GST number, consider visiting the official GST portal.

What documents are needed to get a GST number?

To get a GST number, you will need documents such as proof of business registration, identity and address proof of promoters/partners, and bank account statements or canceled cheque.

Can I get a GST number online?

Yes, you can get a GST number online by registering on the GST portal and completing the application process electronically.

How much does it cost to get a GST number?

The cost of obtaining a GST number is free of charge.

Is there a faster way to get a GST number?

Currently, there is no such process for obtaining a GST number.

What is the process to apply for a GST number?

To apply for a GST number, you are required to visit the official GST portal and complete the registration form. Upload the required documents and submit the application. Once the verification is performed by tax authorities, you will receive the GST number.

Do I need a professional to help me get a GST number?

No, you don’t necessarily require professional help to get a GST number.

How can I check the status of my GST number application?

You can check the status of your GST number application by logging into the GST portal and using the ‘Track Application Status’ feature with your ARN (Application Reference Number).

What should I do if there is a delay in getting my GST number?

If there is a delay in getting your GST number, you should contact the GST helpdesk or your local GST office for assistance or check the status of your application online using your ARN.