India’s taxation system has undergone a lot of changes since the introduction of GST. For those unaware, GST (Goods and Services Tax) is an indirect tax that is imposed on the supply of goods and services. To put it in other words, it is a multi-stage, destination-based tax that is imposed on every value addition.

When we talk about GST, it is very essential to understand another important aspect of GST, GSTIN (GST Identification Number). It is a 15-digit unique code that is assigned to every taxpayer, making its verification crucial for every vendor and business to ensure the authenticity of the entity and compliance with the tax system. But how can you perform a GST number check? Don’t worry; with the help of this guide, you can quickly learn the process.

Before we head on with the process of a GST number check, let us first understand why it is important to perform the verification process.

Reasons to perform a GST number check online

There are several reasons that make verification of the GST number essential. Some of these include:

1) Ensures authenticity: The verification ensures that your GST number is valid and your business is registered.

2) Compliance with regulations: It also makes sure that you are complying with the tax regulations.

3) Prevents fraud: The verification also helps in preventing fake transactions and ensures your business is dealing with authorized organizations.

4) Assists with ITC claims: Lastly, the verification ensures that you can claim ITC (input tax credit) on your transactions.

How to check GST number?

The GST number check is a simple 6-step process. All you need to do is follow the steps mentioned below and quickly verify your GST number.

Step 1: Browse and visit the official GST portal

To verify the GST number online, you need to visit https://www.gst.gov.in. This website is an all-inclusive resource for all GST-related information and services.

Step 2: Look for the ‘Search Taxpayer’ tab.

Once you visit the portal, look for the ‘Search Taxpayer’ tab. You can usually find this tab at the top of the page.

Step 3: Now, select ‘Search by GSTIN/UIN’

Under the ‘Search Taxpayer’ tab, you will find multiple options to search for a taxpayer. Here, you need to select the ‘Search by GSTIN/ UIN’ option.

Step 4: Enter your GST number

After choosing the ‘Search by GSTIN/UIN’ option, you will be notified to enter the GST number that you want to verify. Now, carefully type your 15-digit GSTIN without any spaces or errors to proceed with the GST number check process.

Step 5: Now, complete CAPTCHA

To prevent automated bots from abusing the portal with excessive requests, you need to complete the CAPTCHA challenge. Just enter the characters shown in the image correctly and proceed with the process.

Step 6: Click on the ‘Search’ button

After entering the GST number and completing the CAPTCHA challenge, click on the ‘Search’ button. After that, the system will process your request and display the results.

Thus, this is the simple step-by-step process that you can follow to perform a GST number check. Still, if you need more details regarding the same, you can consider browsing online.

Additional verification Steps to follow during the GST number status check

Usually, the GST portal offers comprehensive information, but there are a few additional steps that you can consider following for thorough verification.

- Verify PAN details: The PAN number is embedded in the GST number. So, make sure you cross-check this with the business’s PAN details to ensure consistency and avoid further problems.

- Don’t forget to check the business address. Check the business address mentioned in the GST registration details. You can even request physical invoices or documents to verify the same.

- Check the returns filing status: On the GST portal, you can even check if the business is regularly filing the GST returns or not.

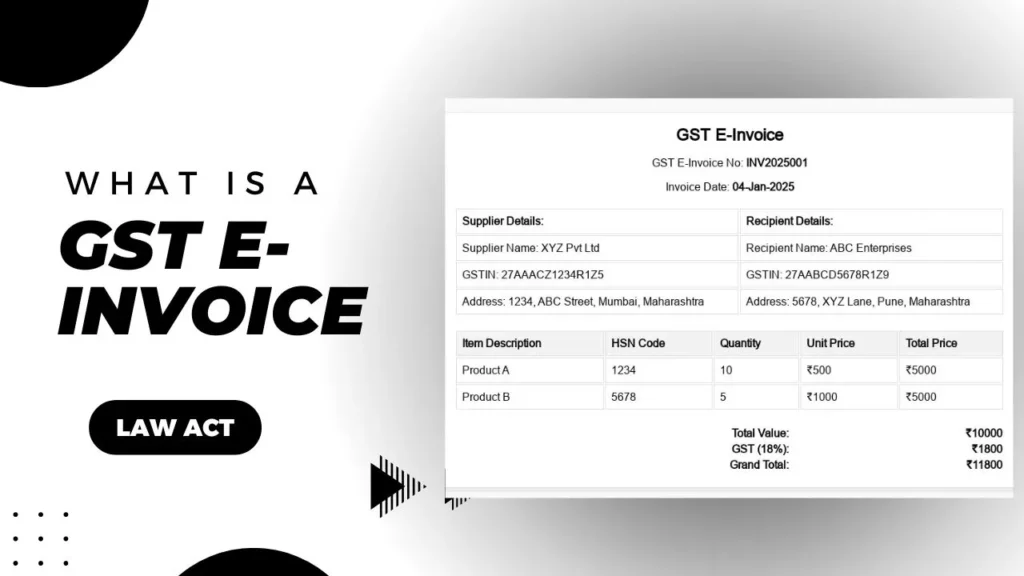

Also Go for Free Formats:

- GST Invoice Format in Excel, Word, Pdf

- GST Invoice Format With Service Charges – Download for Free

- GST Invoice Format With Discount – Download for Free

Troubleshooting tips to prevent common issues during the GST number check

While you perform a GST number check online, there are chances that you will encounter a few issues. So, to help you quickly fix those issues, here are some of the troubleshooting tips that you can consider following.

1) Invalid GST number: If the portal shows an invalid GST number during the GST number check process, double-check the digits. Even a small typing error can lead to this problem.

2) CAPTCHA error: There are chances that you might even encounter a CAPTCHA error. Make sure that you enter the characters correctly. If the CAPTCHA is unclear, make sure that you refresh it and proceed with the process.

3) No results found error: If you encounter this problem, it means that your GST number is either incorrect or not yet registered. So, make sure that you confirm the number with the business.

What are the benefits of a regular GST number check?

Performing regular GST number checks is considered a good practice, especially if you are in a business that frequently deals with new vendors or clients. Apart from that, these regular checks also ensure that you are complying with tax regulations and that all the parties you are transitioning with are legal.

Conclusion

Performing a GST number check online is a simple process that ensures your business’s authenticity and compliance with regulations. So, if you wish to verify your GST number, you can follow the steps provided above and protect your business from fraudulent acts.

Regular GST number checks and thorough verification of the same ensure that you maintain a healthy and compliant business environment in the GST taxation system. So, try to make regular GST number checks as a part of your routine operations to foster trust and compliance in all your business dealings.

Latest Blogs:

- Latest GST 2.0 Rules in 2025The year 2025 has brought one of the biggest reforms in India’s tax system since GST (Goods and Services Tax) was first introduced in 2017. The government has simplified GST slabs, reduced rates on essential goods, increased taxes on luxury… Read more: Latest GST 2.0 Rules in 2025

- All Types of Full Form in GSTGST can be confusing, especially with so many short forms and codes used in the system. Whether you’re a business owner, accountant, or just someone trying to file your GST returns, knowing the full forms and meanings of these terms… Read more: All Types of Full Form in GST

- About GST and Its Impact on the Indian EconomyIntroduction to GST The Goods and Services Tax (GST) is one of the major tax reforms in India since its independence. Implemented on July 1, 2017, GST replaced a plethora of indirect taxes that were previously levied by both central… Read more: About GST and Its Impact on the Indian Economy

- How to check GST number: Step-by-StepIndia’s taxation system has undergone a lot of changes since the introduction of GST. For those unaware, GST (Goods and Services Tax) is an indirect tax that is imposed on the supply of goods and services. To put it in… Read more: How to check GST number: Step-by-Step

- How Does GST Return Penalty WorkThrough this article, we will explain the penalty system associated with GST return filing. By understanding these penalties you can ensure compliance with GST regulations and avoid financial repercussions. We will cover various types of penalties, including late fees, interest on… Read more: How Does GST Return Penalty Work

Frequently asked questions

How can I check my GST number?

To check your GST number, begin by visiting the official GST portal https://www.gst.gov.in. Now, look for the ‘Search Taxpayer’ tab and select ‘Search by GSTIN/UIN’ option. Enter your 15-digit GST number in the designated field and complete CAPTCHA and click on ‘Search’. Once done, the relevant details will be displayed on the screen.

What is the process to verify a GST number?

To verify your GST number, visit the official GST portal. Now, click on the ‘Search Taxpayer’ tab and click on ‘Search GSTIN/UIN’. Enter your GST number that you wish to verify in the field and complete the CAPTCHA challenge. Once done, the portal will display you with the details.

Where can I find an online GST number checker?

You can find an online GST number checker on the official GST portal. Navigate to the ‘Search Taxpayer’ tab and select ‘Search by GSTIN/UIN’ to verify GST numbers.

Can I verify the status of a GST number online?

Yes, you can verify the status of a GST number online by visiting the official GST portal. Use the ‘Search Taxpayer’ tab and select ‘Search by GSTIN/UIN’ to enter the GST number and view its status.

Is there a website to check the validity of a GST number?

Yes, you can check the validity of a GST number on the official GST portal.

How do I know if a GST number is valid or not?

To determine if a GST number is valid, visit the official GST portal at https://www.gst.gov.in. Click on ‘Search Taxpayer’ tab, select ‘Search by GSTIN/UIN’, and enter the 15-digit GST number. Complete the CAPTCHA and click ‘Search’. If the number is valid, the portal will display the associated business details.

What information is required to check a GST number online?

To check a GST number online, you need the 15-digit GST number or PAN details.

Are there any free tools available to check GST numbers?

Yes, there are free tools available to check GST numbers, such as the official GST portal.

How do businesses ensure their GST numbers are correct?

Businesses ensure their GST numbers are correct by regularly verifying them on the official GST portal.

Why is it important to verify GST numbers before doing business?

Verification of GST numbers before doing business is important to ensure the authenticity and legitimacy of the business entity, maintain tax compliance, prevent fraudulent transactions, and enable accurate claiming of Input Tax Credit (ITC).