Introduction to GST

The Goods and Services Tax (GST) is one of the major tax reforms in India since its independence. Implemented on July 1, 2017, GST replaced a plethora of indirect taxes that were previously levied by both central and state governments. This comprehensive, multi-stage, destination-based tax is levied on every value addition and aims to create a single, unified market in India. GST canceled various central taxes like Central Excise Duty, Service Tax, and Additional Customs Duty, as well as state taxes like Value Added Tax (VAT), and Entry Tax, among others.

Structure of GST

The goods and service tax has been divided into 4 broad categories. They are:-

- Central GST (CGST): The CGST or Central GST is levied by the Central Government on intra-state supplies of goods and services.

- State GST (SGST): The SGST or State GST is levied by the State Government on intra-state supplies.

- Integrated GST (IGST): IGST or Integrated GST is levied by the Central Government on inter-state supplies of goods and services.

- Union Territory GST (UTGST): The Union Territory GST is levied on supplies within Union Territories.

Objectives of GST

The primary objectives of GST include:

Simplification: To simplify the indirect tax structure by eliminating the complexities of multiple taxes.

Uniformity: To ensure uniform tax rates and structures across the country.

Elimination of Cascading Effect: To remove the tax-on-tax effect, thereby reducing the overall tax burden.

Increase in Revenue: To enhance the tax base and improve compliance, leading to higher tax revenues.

Boost to Economy: To promote economic growth by creating a single, unified market and improving the ease of doing business.

Implementation and Compliance

The implementation of GST involved a massive overhaul of the existing tax system. The GST Council, a federal body comprising the Finance Minister and state finance ministers, was formed to oversee the implementation and administration of GST. The Council is responsible for making recommendations on tax rates, exemptions, thresholds, and other critical aspects of the GST framework.

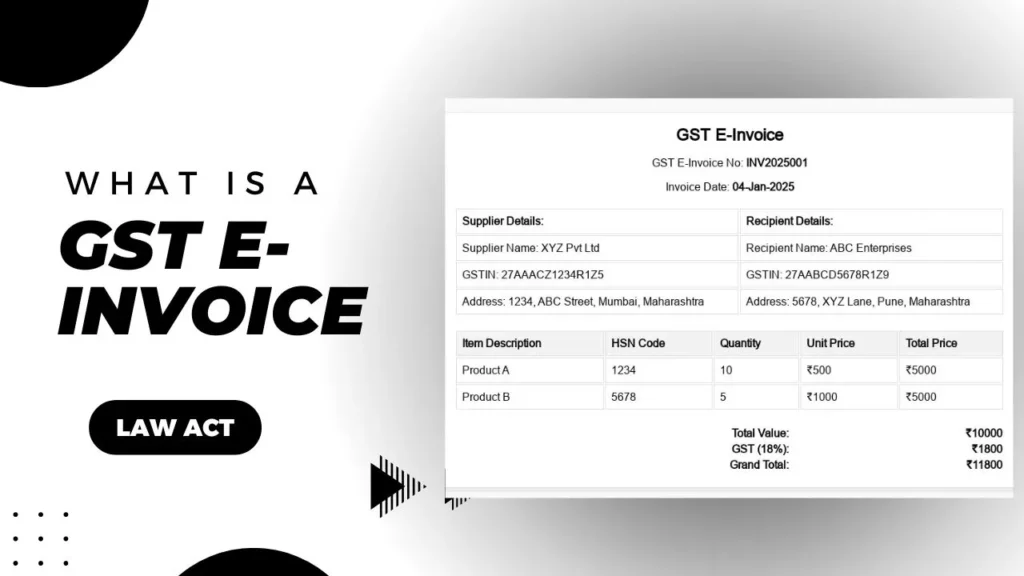

Businesses across India had to adapt to the new tax regime, which required significant changes in accounting systems, invoicing, and compliance procedures. The introduction of the GST Network (GSTN), an IT backbone for GST, facilitated online registration, return filing, and tax payment, thus enhancing transparency and efficiency.

Also Read: How to check GST number: Step-by-Step

Go for Free GST Invoices:

- GST Invoice Format in Excel, Word, Pdf

- GST Invoice Format With Service Charges – Download for Free

- GST Invoice Format With Discount – Download for Free

GST Impact on the Indian Economy

Economic Growth

GST has had a mixed impact on India’s economic growth. Initially, the transition to GST caused disruptions in business operations, leading to a temporary slowdown. However, in the long run, GST is expected to boost economic growth by streamlining the tax structure, reducing the cost of goods and services, and promoting a more efficient allocation of resources.

Ease of Doing Business

GST has significantly improved the ease of doing business in India. The unified tax regime has simplified the tax compliance process, reduced the number of taxes, and minimized the bureaucratic hurdles faced by businesses. The elimination of the cascading tax effect has lowered the overall tax burden, making Indian goods and services more competitive in the global market.

Revenue Generation

GST has positively impacted revenue generation for both central and state governments. The broadening of the tax base and improved compliance have resulted in higher tax collections. Additionally, the implementation of anti-evasion measures, such as e-way bills and invoice matching, has curbed tax evasion and increased the efficiency of tax administration.

Consumer Impact

For consumers, GST has led to a reduction in the prices of goods and services due to the elimination of the cascading tax effect. However, the impact has varied across different sectors. While essential goods and services have become cheaper, some luxury items and services have seen an increase in prices due to higher tax rates.

Sectoral Impact

The impact of GST has varied across different sectors of the economy:

- Manufacturing: The manufacturing sector has benefited from the elimination of multiple taxes and the seamless flow of input tax credits. This has led to a reduction in the cost of production and improved competitiveness.

- –Services: The services sector has faced challenges in adapting to the new tax regime due to increased compliance requirements. However, the unified tax structure has brought greater transparency and efficiency.

- Real Estate: The real estate sector has experienced a mixed impact. While GST has simplified the tax structure, it has also increased the tax burden on under-construction properties, affecting demand.

- E-commerce: The e-commerce sector has benefited from the removal of entry taxes and the implementation of a uniform tax regime, leading to smoother interstate trade.

Challenges and Criticisms

Despite its benefits, GST has faced several challenges and criticisms, after its arrival, here are a few of them discussed below:-

- Compliance Burden: With the oncoming of the GST regime, many small and medium-sized enterprises (SMEs) have struggled with its increased complexity and compliance burden.

- Technical Glitches: The GSTN portal has faced many technical issues, which has hence led to delays in the filing of returns and tax payments.

- High Tax Rates: Many people argue that the high tax rates on certain goods and services have further increased the cost burden on consumers and businesses.

- Revenue Shortfall: Some states have reported a shortfall in revenue collections post-GST implementation, leading to demands for compensation from the central government.

Future Prospects

GST seems to have a promising future in India, with its continuous efforts to address the challenges and improve the system. The government’s constant strive towards simplifying the tax structure, reducing the compliance burden, enhancing the efficiency of the GSTN portal lowering tax rates, and broadening the tax base are being considered to boost economic growth and ensure a more inclusive tax regime.

Conclusion

The introduction of GST in India is a significant milestone in the country’s economic history. Even though the transition has been challenging, the long-term benefits of GST in terms of economic growth, ease of doing business, and revenue generation are undeniable. As the GST regime evolves and matures, it is expected to bring about a more efficient and transparent tax system, ultimately contributing to the overall development and prosperity of the Indian economy.

Also Check:

- Latest GST 2.0 Rules in 2025The year 2025 has brought one of the biggest reforms in India’s tax system since GST (Goods and Services Tax) was first introduced in 2017. The government has simplified GST slabs, reduced rates on essential goods, increased taxes on luxury… Read more: Latest GST 2.0 Rules in 2025

- All Types of Full Form in GSTGST can be confusing, especially with so many short forms and codes used in the system. Whether you’re a business owner, accountant, or just someone trying to file your GST returns, knowing the full forms and meanings of these terms… Read more: All Types of Full Form in GST

- About GST and Its Impact on the Indian EconomyIntroduction to GST The Goods and Services Tax (GST) is one of the major tax reforms in India since its independence. Implemented on July 1, 2017, GST replaced a plethora of indirect taxes that were previously levied by both central… Read more: About GST and Its Impact on the Indian Economy

- How to check GST number: Step-by-StepIndia’s taxation system has undergone a lot of changes since the introduction of GST. For those unaware, GST (Goods and Services Tax) is an indirect tax that is imposed on the supply of goods and services. To put it in… Read more: How to check GST number: Step-by-Step

- How Does GST Return Penalty WorkThrough this article, we will explain the penalty system associated with GST return filing. By understanding these penalties you can ensure compliance with GST regulations and avoid financial repercussions. We will cover various types of penalties, including late fees, interest on… Read more: How Does GST Return Penalty Work

Frequently Asked Questions

What is GST?

A tax regime was implemented by the government, on July 1st, 2017. The Goods and Service Tax works to minus multiple taxes like service tax, VAT, Custom Excise, etc and combine all of them to one destination-oriented tax called GST

What is ITC in GST?

ITC is an abbreviation for Input Tax credit. It is the GST paid on the purchase of goods and services, which will be used for business purposes only. ITC enables businesses to reduce their tax liability.

What is a GST number?

A 15-digit code is allotted to businesses after their registration on the GST portal. A GST number gives the business the status of a GST-identified business. It is a compilation of state code, PAN, entity code, and check digit.

What is RCM in GST?

RCM or Reverse Charge Mechanism is a process where the tax liability is transferred from the dealer to the recipient. For instance, if an unregistered dealer is selling the goods to a registered recipient the recipient becomes liable to pay the tax due.

What is the composition scheme in GST?

The Composition Scheme in GST is a simplified tax scheme for small businesses with an annual turnover of up to ₹1.5 crore. It allows them to pay a fixed percentage of their turnover as tax, reducing compliance and administrative burdens. Businesses cannot claim input tax credit under this scheme.

What is the GST Council?

The GST Council is a constitutional body in India responsible for making recommendations to the central and state governments on issues related to Goods and Services Tax (GST). It is chaired by the Union Finance Minister and includes the Union Minister of State for Finance and finance ministers from all states. The council decides on tax rates, exemptions, and other key aspects of GST policy.

What is a GST return?

A GST return is a document that contains details of income, sales, purchases, and tax paid by a taxpayer under the Goods and Services Tax (GST) regime. It is filed with the tax authorities to report and reconcile tax data. Regular filing of GST returns is mandatory for businesses to ensure compliance and allows for the proper calculation of tax liabilities and claiming of input tax credits.

How does GST work?

GST (Goods and Services Tax) works by levying a single tax on the supply of goods and services from the manufacturer to the consumer. It is collected at each stage of the supply chain, with credits for the taxes paid on previous stages, ensuring only the value addition is taxed.

Why is GST important?

GST is important because it simplifies the tax structure by replacing multiple indirect taxes with a single unified tax. This reduces tax complexity, prevents cascading taxes, promotes ease of doing business, enhances compliance, boosts economic growth by broadening the tax base, and ensures a seamless flow of goods and services across India.

Who needs to register for GST?

Businesses whose annual turnover exceeds the threshold limit set by the government and those who are involved in the interstate supply of goods are liable to register for the GST.

How to calculate GST?

To calculate GST, use this formula:

GST Amount = (Original Price × GST Rate) / 100

Add the GST amount to the original price for the final price. For example, if a product costs ₹1,000 and the GST rate is 18%, the GST amount is ₹180, and the final price becomes ₹1,180.

How many types of GST are there?

India has four types of GST:

CGST (Central GST)

SGST (State GST)

UTGST (Union Territory GST)

IGST (Integrated GST)

These ensure tax sharing between the central and state governments.