Through this article, we will explain the penalty system associated with GST return filing. By understanding these penalties you can ensure compliance with GST regulations and avoid financial repercussions. We will cover various types of penalties, including late fees, interest on late payments, and penalties for non-filing or errors. So let’s dive into the intricacies of GST return penalty to ensure your business stays compliant, saves costs, and strategizes effectively.

What is GST?

The Goods and Services Tax (GST) is a complete, multi-tiered, destination-based tax that is imposed on all value additions in India. It was implemented on July 1, 2017, and replaced several indirect taxes such as VAT, service tax, and excise duty, simplifying the tax structure. The main objectives of the GST are to create a single national market, lessen the cascading effect of taxes, and improve compliance. The GST has also eased the burden of doing business, promoting economic growth and raising revenue for the federal and state governments.

Understanding GST Returns

GST returns are periodic statements that businesses registered under the Goods and Services Tax (GST) system must file with the tax authorities. These returns contain detailed information about the business’s sales, purchases, output GST (tax on sales), and input tax credit (tax paid on purchases). The primary purpose of GST returns is to ensure that the tax authorities have accurate and up-to-date information on tax liabilities and credits for each registered entity. Now let’s move ahead to explore the type of GST returns.

Types of GST Return

There are three types of GST returns we are going to talk about that is GSTR-1, GSTR-3B, and GSTR-9. Read ahead to know more.

GSTR-1: A detailed monthly return capturing all outward supplies of goods and services, showcasing sales and revenue generated by the business.

GSTR-3B: A concise monthly self-declared summary return for the payment of taxes, summarizing overall tax liabilities and input credits.

GSTR-9: A comprehensive annual return that consolidates all monthly or quarterly returns filed throughout the year, providing an in-depth overview of the business’s tax activities and ensuring accurate tax reconciliation.

These are GST returns that are required to be filled by the business. Timely and accurate GST return filing is crucial to avoid penalties, interest charges, and compliance issues. It ensures seamless tax credits, legal compliance, and financial health, protecting businesses from costly fines and disruptions in operations.

Late Fees for GST Returns

To ensure compliance and timely tax revenue for the government, late fees in the GST are penalties for taxpayers for failing to file their GST returns on time.

The specific late fees applicable for different returns:

- GSTR-3B and GSTR-1: Rs. 50 per day (Rs. 25 each for CGST and SGST), reduced to Rs. 20 per day if there is no tax liability.

- GSTR-9: Rs. 200 per day (Rs. 100 each for CGST and SGST), with a maximum cap.

Samples Showing How Late Fees Can Add Up

Example 1: Tax Liability and GSTR-3B Late Fees

A tax-liable business submits its GSTR-3B return ten days beyond the deadline.

Calculation of Late Fee: Rs. 50 per day (CGST and SGST fees of Rs. 25 each).

The total amount of the late fee is Rs. 500 (10 days x Rs. 50) (Rs. 250 for CGST and Rs. 250 for SGST).

Example 2: No Tax Liability and GSTR-3B Late Fees

A company that does not owe taxes submits its GSTR-3B return ten days overdue.

Calculation of Late Fee: Rs. 20 each day (CGST and SGST fees of Rs. 10 each).

Ten days times twenty rupees is the total late fee of Rs. 200 (Rs. 100 for CGST and Rs. 100 for SGST).

Example 3: Late Fees on GSTR-9

A company submits its yearly GSTR-9 return with 15 days’ delay.

Calculation of Late Fee: Rs. 200 each day (CGST and SGST fees of Rs. 100 each).

The entire late fee is Rs. 3,000 (15 days x Rs. 200, of which Rs. 1,500 is for CGST and Rs. 1,500 is for SGST).

These illustrations show how late fines may scale up rapidly, highlighting how crucial it is to file on time to avoid incurring penalties.

To ensure compliance and timely tax revenue for the government, late fees in the GST are penalties for taxpayers for failing to file their GST returns on time.

Interest on Late Payments

Interest Charge Mechanism for Late GST Payments

In case of delayed remittance of GST, there shall be an interest charge on such belated payment. Such interest levied would be 18 per cent per annum. At par, this would imply that for every day one’s payment is late, a fraction of the yearly rate shall be levied on the outstanding GST amount.

Interest Rate and Calculation Method

18 per cent per annum will be the interest rate for late payments towards the GST. The following is the formula to determine the interest to be charged:

- Interest=(18100×Number of Days Late365×Outstanding GST Amount)\text{Interest} = \left( \frac{18}{100} \times \frac{\text{Number of Days Late}}{365} \times \text{Outstanding GST Amount} \right)Interest=(10018×365Number of Days Late×Outstanding GST Amount)

Scenarios Where Interest is Applicable

Interest applies in scenarios such as:

- Late payment of GST after the due date.

- Incorrectly availing excess input tax credit.

- Understatement of GST liability.

Importance of Avoiding Interest Charges Through Timely Payments

It is essential to avoid interest charges by making payment of the GST on time. It saves money and also keeps your financial records clean, which avoids additional costs and complications.

Penalties for Non-Filing and Continuous Non-Compliance

There are heavy penalties and repercussions in case of failure to file the GST returns. The tax authorities may issue a show-cause notice demanding an explanation for non-filing, after which non-response may attract penalties or suspension and even cancellation of GST registration.

Process of Show-Cause Notice

Upon failure to file returns, the tax authorities will initiate the show-cause notice process. This notice calls for a response within the period specified therein as to why the returns have not been filed.

Potential Consequences

In case of an adverse response to a show-cause notice or an unsatisfactory explanation, the consequences can be very severe. Suspension or cancellation of this registration results in disruption of business and thus affects legal compliances.

What to Do if You Receive a Show-Cause Notice?

If you get a show-cause notice, take it seriously and respond as early as possible with a valid explanation. Take corrective measures immediately by filing overdue returns and paying pending GST so that further penalties may be avoided.

Penalties for Specific Errors or Fraud

Genuine Errors vs. Fraudulent Activities: The former are those mistakes that do not involve an intent to deceive, while the latter refers to activities wherein taxes are deliberately evaded.

Penalties for Under-Reporting or Misreporting: For under-reporting or misreporting of GST, the penalty is 10% of the tax due or Rs. 10,000, whichever is higher, subject to the condition that the mistake is committed without fraudulent intent.

Penalties for Deliberate Tax Evasion: However, deliberate tax evasion carries a penalty of 100% of the due tax. This is more stringent than previous legislation in an attempt to deter deliberate non-compliance.

Penalties in Certain Cases: In this case, for example, if a business understates its GST by Rs. 50,000, it will have to pay a fine of Rs. 10,000 for a bonafide mistake. If there is deliberate evasion of the same amount, then the penalty for the business would be Rs. 50,000.

Filing Timelines and Compliance

Monthly and Quarterly Returns: GSTR-1 and GSTR-3B need to be filed every month, while quarterly returns can be filed under the QRMP scheme.

Annual Return Filing Requirement: The annual return shall be filed in GSTR-9 form to summarize the year’s GST transactions.

Why are these timelines important?: Sticking to the above timelines is necessary for compliance, to avoid penalties, and for the smooth running of a business.

How to Avoid GST Penalties

Strategies to File on Time: Use reminders and automated systems for the timely filing of GST returns.

Importance of Correct Reporting: Correct reporting ensures there is no discrepancy and thus no penalties.

Reconciliation Regularly: Your books should reconcile with the GST returns as regularly as possible.

Benefits of Being Compliant: Compliance would avoid financial penalties, and legal hassles, and will also keep your business operations smooth.

Conclusion

Through the above article, we have explained how the GST return penalty works. Proper care and understanding of the need to file GST returns are the essence of keeping away from penalties and running business operations smoothly. This keeps your business running efficiently and steers clear of many other financial and legal problems.

Also Read:

- How to check GST number: Step-by-Step

- GST on Rent in India: A Comprehensive Guide

- How to Get a GST Number: A Step-by-Step Guide

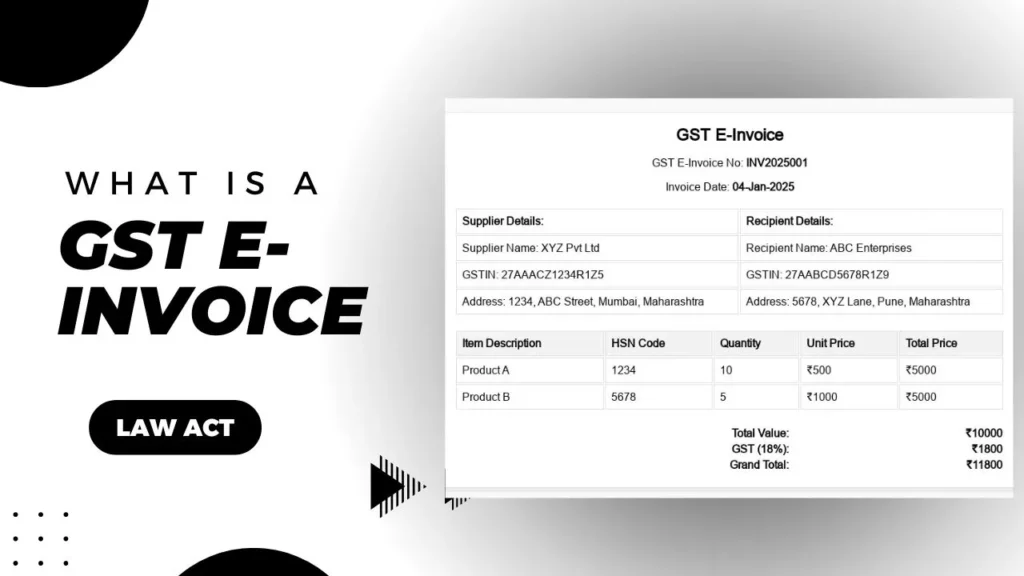

- What is a GST E-Invoice and How Does It Work?

- About GST and Its Impact on the Indian Economy

Frequently Asked Questions

What is GST return penalty and when is it applied?

There is no provision for a grace period in the case of GST return filing. Late fees and interest apply right from the first day after the due date. Therefore, returns must be filed on or before the due date to avoid penal provisions.

How is the GST late fee calculated?

Such incorrectly filed GST returns may attract a penalty, interest on reduced payment of tax, and other possible problems with tax authorities. There are options for rectifying such errors, either through amendments or by reaching out to GST support.

What happens if you file GST returns late?

The steps for checking online the status of the GST penalty include logging into the GST portal, clicking on the “Services” tab, selecting “Ledgers,” and further clicking on “Electronic Liability Register.” You can view the pending penalties and interest here.

Can GST penalties be avoided or reduced?

GST return penalty can be avoided or reduced only if there are on-time filings and accuracy. One can ensure this by regular reconciliation of accounts and setting automated reminders for submissions. Even in such cases, authorities may waive off the penalties for genuine mistakes or on account of hardship.

How does GST interest on late payment work?

Interest is charged at the rate of 18% per annum in case a person fails to make a timely payment of GST. Such interest will be charged on the amount outstanding regarding the tax payable from the day after the due date until the date of its payment.

What are the consequences of not filing GST returns?

The implications of non-filing GST returns can lead to GST return penalty and interest levies, and even a show-cause notice can be raised by the tax authorities. Constant non-compliance may result in suspension or even the cancellation of the GST registration, further impacting business operations.

How to pay GST penalties and late fees?

GST return penalty and other charges can be paid online through the GST portal. Log in, select the period relevant to the return, calculate the amount payable, and make payment in a mode of your choice.

Is there a grace period for GST return filing?

There is no provision for a grace period in the case of GST return filing. Late fees and interest apply right from the first day after the due date. Therefore, returns must be filed on or before the due date to avoid penal provisions.

What happens if GST returns are filed incorrectly?

Such incorrectly filed GST returns may attract a penalty, interest on reduced payment of tax, and other possible problems with tax authorities. There are options for rectifying such errors, either through amendments or by reaching out to GST support.

How to check GST penalty status online?

The steps for checking online the status of the GST return penalty include logging into the GST portal, clicking on the “Services” tab, selecting “Ledgers,” and further clicking on “Electronic Liability Register.” You can view the pending penalties and interest here.